2013 will be an extraordinary confluence of wrong thinking and financial mistakes. Government interference with markets is growing and this is creating great economic and financial strains.

EUROPE.

We have already read about the financial turmoil in Greece, Ireland, Portugal, Spain and Italy, but now we add one more to this toxic brew: France. The election of a Socialist government ensures that financial common sense will leave the Gallic shores. Sure enough, the French tried to raise confiscatory taxes on top earners, causing an exodus of capital, along with those who earn it. While, a French court struck down the infamous 75% tax on incomes above E1M/yr, this just adds to the confusion. What's the problem? French banks, you see, are an important linch pin in world trade and with France increasingly vulnerable to the stupidities that plague Socialist countries, the reputation of these banks is suffering. You will hear more of this as the trend unfolds.

JAPAN.

Japan has elected a government that promised to print money to reduce the value of the YEN. The stupids that now run the country believe that destroying the value of their currency will help export and thus, their economy. Japan's PM Abe is on board with this and so is their Finance Minister Aso. What these people do not realize is that a cheaper currency might help exports, but it makes imports more expencive. And Japan imports a lot of things, including oil. With their atomic power still in the dog house, Japan must import more oil.Also, Japanese banks are also involved in financing international trade and a falling currency will hurt these banks. Japan has a shrinking population, hence their push for robotics.

THE UNITED STATES.

Unfortunately, the US has also fallen into the category of countries where stupidity had overtaken the population. BHO and the Democrats had solidified their hold on America, which is bad news for the Country and the economy. The Fisal Cliff will send us deeper into economic stagnation. US credit rating will suffer and we will slip into recession. Bernanke will increase printing, but without increasing money velocity, the printing will heve little beneficial effect. If Larry is correct, gold will resume its climb as investment opportunities grow scarce.

Monday, December 31, 2012

Saturday, December 29, 2012

Larry explains.

1. Why isn't the printing working?

I have asked this a number of times. And attributed the failure of the Bernanke effort (to increase the money supply in order to speed the economy) to having the new money sequestered as "Reserves." In addition, says Larry, the new money is sunk into Treasuries (because it brings a guaranteed return when interest rates are near zero) and this mountain of money goes nowhere, its velocity is zero.

2. Why is inflation low?

A: Because the money velocity is slow.

3. Will this change?

A: Yes and soon.

4. How soon?

A: Between January and June.

5. What will set off the change?

A: The realization will hit investors that the US is broke and the $16T will never be paid back. The Treasuries bubble then will bust and Treasuries will decline. Here is the 30 yr Treasuries graph:

The graph shows that Treasuries topped out and are beginning to decrease in value. A monthly close below 146 (and a trendline which is at 144 now) will start the cracking of the Treasuries.

6. What will the cracking of the Treasuries do?

A: The value of the Treasuries will decrease as Investors rush to the exit and put their money in commodities, real estate, gold and silver and selected stocks.

7. Will Bernanke try to stem this tide?

A: Most likely. The FED will try to buy up the 30y Treasuries sold, but it can't speed the Money Velocity. Larry thinks that between now and when gold takes off, there might be another round of drop in gold prices.

8. Do I believe that gold will drop between now and the end of the correction?

A: Gold has already dropped even as the Treasuries graph is topping. However, there are a lot of people and countries buying, so we may not see the lows Larry is talking about (i.e. 1,400/oz).

9. Will we have hyperinflation?

A: Larry does not think so. His reason? The economy will collapse before we get there.

10. What will the Fiscal Cliff do?

A: Between Obama and the Media they have browbeaten the House to give in and let the Dems in the Senate dictate the outcome. And there will be no real cuts except for the military. One Dem said that agreeing to cuts for a Democrat was like killing your children. So, between an increase in taxes and no real cuts in spending, the result will be a slowdown.

I have asked this a number of times. And attributed the failure of the Bernanke effort (to increase the money supply in order to speed the economy) to having the new money sequestered as "Reserves." In addition, says Larry, the new money is sunk into Treasuries (because it brings a guaranteed return when interest rates are near zero) and this mountain of money goes nowhere, its velocity is zero.

2. Why is inflation low?

A: Because the money velocity is slow.

3. Will this change?

A: Yes and soon.

4. How soon?

A: Between January and June.

5. What will set off the change?

A: The realization will hit investors that the US is broke and the $16T will never be paid back. The Treasuries bubble then will bust and Treasuries will decline. Here is the 30 yr Treasuries graph:

The graph shows that Treasuries topped out and are beginning to decrease in value. A monthly close below 146 (and a trendline which is at 144 now) will start the cracking of the Treasuries.

6. What will the cracking of the Treasuries do?

A: The value of the Treasuries will decrease as Investors rush to the exit and put their money in commodities, real estate, gold and silver and selected stocks.

7. Will Bernanke try to stem this tide?

A: Most likely. The FED will try to buy up the 30y Treasuries sold, but it can't speed the Money Velocity. Larry thinks that between now and when gold takes off, there might be another round of drop in gold prices.

8. Do I believe that gold will drop between now and the end of the correction?

A: Gold has already dropped even as the Treasuries graph is topping. However, there are a lot of people and countries buying, so we may not see the lows Larry is talking about (i.e. 1,400/oz).

9. Will we have hyperinflation?

A: Larry does not think so. His reason? The economy will collapse before we get there.

10. What will the Fiscal Cliff do?

A: Between Obama and the Media they have browbeaten the House to give in and let the Dems in the Senate dictate the outcome. And there will be no real cuts except for the military. One Dem said that agreeing to cuts for a Democrat was like killing your children. So, between an increase in taxes and no real cuts in spending, the result will be a slowdown.

Sunday, December 23, 2012

Taxmageddon.

We have four questions to answer: 1. What is the size of the tax increase coming Jan 1? 2. Are Obama and the Democrats interested in preventing it? 3. Who will get the blame? and 4. What is the "Obama Plan?"

Q1. Hard to estimate the actual increases in taxes that will start Jan 1. Here are some increases:

1. A 2% increase in FICA taxes;

2. Cap gains will go up significantly, for some people as much as double;

3. Personal rates will go up above 35K/y;

4. Inheritance taxes will cut in at $1M and go from 35% to 55%;

5. Alternative minimum tax will be invoked for 33M people as opposed to 7M now;

6. Medicare taxes will increase;

7. There will be new Medicare taxes

There will be numerous taxes on business that will go up, including Obamacare.

Q2. Are the Democrats interested in avoiding the Fiscal Cliff? The answer to that is a resounding NO!. The Dems have avoided every proposal advanced by the hapless Boner. The Fiscal Cliff will increase taxes and allow the government to control an even larger percentage of the Nation's income. A majority of Democrats (53%) think Socialism is OK and they want it.

Q3. Who will get the blame? Easy. The Republicans.

Q4. Imagine that the Deficit is like having a Hurricane Sandy every two weeks. Obama's plan will prevent two of those hurricanes, under the best assumptions. What will rally happen? Increasing taxes by 10% will not increase revenues by ten percent. First, because people will turn to schemes to reduces their taxes. This will slow the economy. And the slower the economy, the lower the tax take will be. If the Obama solution is ,implemented, the deficit will go up. The problem is that the Media is allowing the Dems to demagogue and lie through their teeth AND the GOP is helpless in explaining its case. Blacks and Hispanics are happy to stick it to us and besides they do not understand anything about economics and taxes.

Q1. Hard to estimate the actual increases in taxes that will start Jan 1. Here are some increases:

1. A 2% increase in FICA taxes;

2. Cap gains will go up significantly, for some people as much as double;

3. Personal rates will go up above 35K/y;

4. Inheritance taxes will cut in at $1M and go from 35% to 55%;

5. Alternative minimum tax will be invoked for 33M people as opposed to 7M now;

6. Medicare taxes will increase;

7. There will be new Medicare taxes

There will be numerous taxes on business that will go up, including Obamacare.

Q2. Are the Democrats interested in avoiding the Fiscal Cliff? The answer to that is a resounding NO!. The Dems have avoided every proposal advanced by the hapless Boner. The Fiscal Cliff will increase taxes and allow the government to control an even larger percentage of the Nation's income. A majority of Democrats (53%) think Socialism is OK and they want it.

Q3. Who will get the blame? Easy. The Republicans.

Q4. Imagine that the Deficit is like having a Hurricane Sandy every two weeks. Obama's plan will prevent two of those hurricanes, under the best assumptions. What will rally happen? Increasing taxes by 10% will not increase revenues by ten percent. First, because people will turn to schemes to reduces their taxes. This will slow the economy. And the slower the economy, the lower the tax take will be. If the Obama solution is ,implemented, the deficit will go up. The problem is that the Media is allowing the Dems to demagogue and lie through their teeth AND the GOP is helpless in explaining its case. Blacks and Hispanics are happy to stick it to us and besides they do not understand anything about economics and taxes.

Tuesday, December 18, 2012

More on the areal stunt of Central Banks.

Are the Central Banks following the lead of the FED? Here is a graphic of the assets of the European Central Bank(ECB).

Does gun control help?

There are ambulance chaser lawyers who follow the injured to profit from an accident. And there are ambulance chasing Democrats who follow every mass killing demanding more stringent gun control. Do these laws help though?

Figure 1 shows the stringency of gun control laws. In fact, the State of Connecticut has some of the strongest gun control laws. So, those laws do not prevent mass killings. Preventing sickos from shooting people is not their purpose. Even if people had no guns, mayhem could be committed by a knife (as in China where 20 school kids had been slashed by a sicko). The worst case of school violence has been committed by dynamite:

Making schools "gun free zones" is an advertisement telling sickos that people in that area had been disarmed for the sickos' convenience.

The Left wants to disarm America so a Marxist dictatorship can be imposed.

Figure 1 shows the stringency of gun control laws. In fact, the State of Connecticut has some of the strongest gun control laws. So, those laws do not prevent mass killings. Preventing sickos from shooting people is not their purpose. Even if people had no guns, mayhem could be committed by a knife (as in China where 20 school kids had been slashed by a sicko). The worst case of school violence has been committed by dynamite:

Making schools "gun free zones" is an advertisement telling sickos that people in that area had been disarmed for the sickos' convenience.

The Left wants to disarm America so a Marxist dictatorship can be imposed.

Monday, December 17, 2012

The metaphore of the areal stunt.

Areal stunts are a tradition in America. It is a long way from the Wing Walkers to the Blue Angels, but America's best pilots put on a show that is absolutely breath taking. The show relies on technology, coordination and courage. The planes fly in a tight formation with wing tips 18 inches from each other. Each pilot cues in the next plane and all follow the lead plane. One false move and disaster! Perhaps the most famous and most dangerous stunt is the backward loop: the planes fly straight up then loop backwards and streak toward the ground. Then they pull out of the dive and streak by the field at a 100 feet altitude with a teeth rattling boom that leaves Spectators awe struck.

Everything must work perfectly, every pilot must perform flawlessly. One faulty component, one pilot making a mistake spells disaster not only for the planes and the pilots, but spectators as well. Like the 1982 Air Force Thunderbirds. Doing the backward loop, the pilots followed the lead plane which never pulled out. One tiny component did not perform as required and four brave pilots died that day.

KingWorld News' Fitzwilson likens the machinations of the world's Central Banks to the flight of the Thunderbirds. Central Banks are following the lead of the FED which has embarked on an unprecedented venture of printing money, suppressing gold prices and distorting interest rates. We are told that the FED will pull out of this dive before disaster hits. I guess every generation produces men with hubris who believe that they know everything, can control everything and nothing will go wrong. At stake is the fate of the US Dollar and the financial institutions of the whole world.

Meanwhile, the Obama regime is engaged in its own dive, with the Media acting as an enabler propagandist. Raising taxes on the top two percent of earners is a tool to crash the economy and destroy Capitalism.

Surely, you must think, I am exaggerating. Unfortunately not. The top two percent of EARNERS includes the Nation's small business men responsible for 60% of job creation. Tax them at a higher rate and we go into a Depression. Why would going back to Clinton's tax rates create such havoc, you might ax. Because the Budget is now 4x what it was under Clinton and there is no way to have a balanced budget without going into a Marxist seizure of private property. And that is the aim of the Obama regime.

Everything must work perfectly, every pilot must perform flawlessly. One faulty component, one pilot making a mistake spells disaster not only for the planes and the pilots, but spectators as well. Like the 1982 Air Force Thunderbirds. Doing the backward loop, the pilots followed the lead plane which never pulled out. One tiny component did not perform as required and four brave pilots died that day.

KingWorld News' Fitzwilson likens the machinations of the world's Central Banks to the flight of the Thunderbirds. Central Banks are following the lead of the FED which has embarked on an unprecedented venture of printing money, suppressing gold prices and distorting interest rates. We are told that the FED will pull out of this dive before disaster hits. I guess every generation produces men with hubris who believe that they know everything, can control everything and nothing will go wrong. At stake is the fate of the US Dollar and the financial institutions of the whole world.

Meanwhile, the Obama regime is engaged in its own dive, with the Media acting as an enabler propagandist. Raising taxes on the top two percent of earners is a tool to crash the economy and destroy Capitalism.

Surely, you must think, I am exaggerating. Unfortunately not. The top two percent of EARNERS includes the Nation's small business men responsible for 60% of job creation. Tax them at a higher rate and we go into a Depression. Why would going back to Clinton's tax rates create such havoc, you might ax. Because the Budget is now 4x what it was under Clinton and there is no way to have a balanced budget without going into a Marxist seizure of private property. And that is the aim of the Obama regime.

Friday, December 14, 2012

Is the FED manipulating?

If you do not believe that SOMEBODY is manipulating things recall the announcement Wednesday: the FED is going to print $85B/month. //Do you recall the post about QEIV?// Well, the printing is now announced. Monetary inflation up the kazoo. And what happenes to gold prices? They go down $25/oz. Makes no sense does it not?

That's not the only thing that does not compute. VIX (the volatility or fear index) is related to many economic variables. Normal correlation has now broken down on a massive scale:

http://pragcap.com/the-vix-is-it-telling-us-anything-at-all

That's not the only thing that does not compute. VIX (the volatility or fear index) is related to many economic variables. Normal correlation has now broken down on a massive scale:

http://pragcap.com/the-vix-is-it-telling-us-anything-at-all

Thursday, December 13, 2012

FED will print $1T next year.

Here is an exerpt from the report on the latest FED meeting.

"To support a stronger economic recovery and to help ensure that inflation, over time, is at the rate most consistent with its dual mandate, the Committee will continue purchasing additional agency mortgage-backed securities at a pace of $40 billion per month. The Committee also will purchase longer-term Treasury securities after its program to extend the average maturity of its holdings of Treasury securities is completed at the end of the year, initially at a pace of $45 billion per month. The Committee is maintaining its existing policy of reinvesting principal payments from its holdings of agency debt and agency mortgage-backed securities in agency mortgage-backed securities and, in January, will resume rolling over maturing Treasury securities at auction. Taken together, these actions should maintain downward pressure on longer-term interest rates, support mortgage markets, and help to make broader financial conditions more accommodative."

Add it up: $40B for mortgage-backed securities and $45B Treasury securities for a total of $85B/month. Multiply $85B/mo by 12 months gets us $1,020B or $1T rounded down. NOTE! The $45B purchase (printing for Treasuries) will be the INITIAL PACE!!!

"To support a stronger economic recovery and to help ensure that inflation, over time, is at the rate most consistent with its dual mandate, the Committee will continue purchasing additional agency mortgage-backed securities at a pace of $40 billion per month. The Committee also will purchase longer-term Treasury securities after its program to extend the average maturity of its holdings of Treasury securities is completed at the end of the year, initially at a pace of $45 billion per month. The Committee is maintaining its existing policy of reinvesting principal payments from its holdings of agency debt and agency mortgage-backed securities in agency mortgage-backed securities and, in January, will resume rolling over maturing Treasury securities at auction. Taken together, these actions should maintain downward pressure on longer-term interest rates, support mortgage markets, and help to make broader financial conditions more accommodative."

Add it up: $40B for mortgage-backed securities and $45B Treasury securities for a total of $85B/month. Multiply $85B/mo by 12 months gets us $1,020B or $1T rounded down. NOTE! The $45B purchase (printing for Treasuries) will be the INITIAL PACE!!!

Is there another Act in the Greek drama?

Yes is the answer. AP reports that "In one whirlwind morning, the European Union nations agreed on the foundation of a fully fledged banking union and Greece's euro partners approved billions of euros in bailout loans that will prevent the nation from going bankrupt."

By now we understand that what AP reports is not the complete truth or even an incomplete truth, but a sort of polyyannaish glossover of some facts. What is the "foundation of a fully fledged banking union" for example. Well, it is the ECB supervising banks of a certain size. And what is meant by supervising? To be hammered out later. What will be the rules that they agreed to? Unknown. Who has the authority to approve the rules? You would think maybe the ECB, but by now we have come to understand that these phrases will be the foundation of endless bickering and meetings.

Far more concrete is what was decided on Greece. Remember the last post devoted to Greece? The agreement to provide Greece with rescue funds? Well, this last meeting reaffirmed this determination. Between now and March, Greece is to receive $64B in funds of which over half is to be delivered soon. [What, no further meetings?] It is mentioned that the Greek govt is to buy back bonds held privately, but at 1/3 of their face value. So, the Rescue Fund is timed to pay for the partial bond default and THEN Greece will get some funds for operations.

I am not going to repeat the BS uttered by the participants of the conference about restoring confidence in Greece's business climate and so forth. The agony of the Greek people is what happens when a country far gone into the idiocy of Leftism is being dragged back into the real world.

By now we understand that what AP reports is not the complete truth or even an incomplete truth, but a sort of polyyannaish glossover of some facts. What is the "foundation of a fully fledged banking union" for example. Well, it is the ECB supervising banks of a certain size. And what is meant by supervising? To be hammered out later. What will be the rules that they agreed to? Unknown. Who has the authority to approve the rules? You would think maybe the ECB, but by now we have come to understand that these phrases will be the foundation of endless bickering and meetings.

Far more concrete is what was decided on Greece. Remember the last post devoted to Greece? The agreement to provide Greece with rescue funds? Well, this last meeting reaffirmed this determination. Between now and March, Greece is to receive $64B in funds of which over half is to be delivered soon. [What, no further meetings?] It is mentioned that the Greek govt is to buy back bonds held privately, but at 1/3 of their face value. So, the Rescue Fund is timed to pay for the partial bond default and THEN Greece will get some funds for operations.

I am not going to repeat the BS uttered by the participants of the conference about restoring confidence in Greece's business climate and so forth. The agony of the Greek people is what happens when a country far gone into the idiocy of Leftism is being dragged back into the real world.

Wednesday, December 12, 2012

The death throes of California.

In the 80s we used to say that as goes California, so goes the Nation. Maybe it is true. If it is, we are in big trouble. A Bloomberg article details California's woes with compensation for public employees:

http://www.bloomberg.com/news/2012-12-11/-822-000-worker-shows-california-leads-u-s-pay-giveaway.html

"Demographics is destiny" say Democrats and they have loaded California with third world people who have no inkling of sound government, fiscal responcibility and such. These people want "free" stuff from the state and the Democrats are all too eager to step in and give it to them. Leftists of all kinds, along with potheads now are the prominent forces of this once fertile and abundunt land known as California. Look at the hate-filled faces of Oakland's protesters (one of the pictures that accompanies the article), they are like the union thugs of Michigan and Wisconsin. As California sinks into unpayable debts, so does the Nation. It will be not long untill ethnic and union mobs will run wild in the street and just demand "free" stuff.

http://www.bloomberg.com/news/2012-12-11/-822-000-worker-shows-california-leads-u-s-pay-giveaway.html

"Demographics is destiny" say Democrats and they have loaded California with third world people who have no inkling of sound government, fiscal responcibility and such. These people want "free" stuff from the state and the Democrats are all too eager to step in and give it to them. Leftists of all kinds, along with potheads now are the prominent forces of this once fertile and abundunt land known as California. Look at the hate-filled faces of Oakland's protesters (one of the pictures that accompanies the article), they are like the union thugs of Michigan and Wisconsin. As California sinks into unpayable debts, so does the Nation. It will be not long untill ethnic and union mobs will run wild in the street and just demand "free" stuff.

Germany now in recession.

Europe's economic troubles deepened with the "surprise" October drop of German industrial output. The only thing of dispute is the size of the drop. Three different sources report three different numbers, ranging from -1.2% to -2.8%. Forecasts for the German economy are negative for Q4. This would make for three consecutive quarters of economic contraction in Germany.

The German drop is in line with the drops in Italy and Greece.

The German drop is in line with the drops in Italy and Greece.

Tuesday, December 11, 2012

Italy reshuffles the deck.

Just when you thought you had the Italian scene figured, the government fell Friday after Berlusconi's Party left the coalition. While, speculation is rampant about the future of now former PM Mario Monti, interest now is focused on the coming election in February.

The main players.

The election pits Berlusconi (center right) against Bersani, an actual member of the Communist Party.

The main issue.

Monti was a "reform" politician, which in today's parlance is someone seeking "austerity" and reduction in spending by the govt. Neither Berlusconi, nor Bersani want to continue with the Monti "reforms" that put Italy into a recession.

Response of the Markets.

So far, the response of the Markets is an increase in Italian bond yields. The Markets expect a return to the pre-Monti days if Berlusconi is successful and an outright disaster if the Communits come to power.

What about Berlusconi?

Berlusconi is a Billionaire and has the reputation of an Italian stud. Remember his 'bunga bunga' parties? Anyway, he was accused of having sex with an underage prostitute. She disappeared. This does sound like a mystery novel.

The main players.

The election pits Berlusconi (center right) against Bersani, an actual member of the Communist Party.

The main issue.

Monti was a "reform" politician, which in today's parlance is someone seeking "austerity" and reduction in spending by the govt. Neither Berlusconi, nor Bersani want to continue with the Monti "reforms" that put Italy into a recession.

Response of the Markets.

So far, the response of the Markets is an increase in Italian bond yields. The Markets expect a return to the pre-Monti days if Berlusconi is successful and an outright disaster if the Communits come to power.

What about Berlusconi?

Berlusconi is a Billionaire and has the reputation of an Italian stud. Remember his 'bunga bunga' parties? Anyway, he was accused of having sex with an underage prostitute. She disappeared. This does sound like a mystery novel.

Sunday, December 9, 2012

Gold's inflection point.

Gold prices have not changed much in over a year. This is prompting some folks to write about the end of the Bull Market in gold. Goldman Sux, for example, has reduced its forecast for gold prices. The rationale is based on the forecast that the European and US economies will recover in 2013, interest rates will go up and investing in gold will go down.

Goldman would be more persuasive if it was not being reported that Goldman is buying gold for China and, therefore, they have an ax to grind. Forecasts for economic recovery are equally dubious. Numbers are absolutely dismal for Europe and not better for the United States. Take the last employment report. We know that the US needs at least 250K new hires/month for employment to stay even. So, how could a 143K new jobs reduce unemployment from 7.9% to 7.5? It is because the labor force is shrinking, that's how. If you divide the number of workers working by an ever decreasing number of total workers, you will get the impression that the %employment is increasing. In actual fact, the number of the work force working is decreasing.

The FED is getting set to continue expanding the money supply and Central Banks are still buying gold. Gold prices are kept low by big sales of paper gold, i. e. gold that exists on paper. We know, for example, that Germany's gold has been leased out for just such a purpose. Bernanke will outdo himself printing in hopes of countering the negative effects of rising taxes and continued spending. He will fail.

Goldman would be more persuasive if it was not being reported that Goldman is buying gold for China and, therefore, they have an ax to grind. Forecasts for economic recovery are equally dubious. Numbers are absolutely dismal for Europe and not better for the United States. Take the last employment report. We know that the US needs at least 250K new hires/month for employment to stay even. So, how could a 143K new jobs reduce unemployment from 7.9% to 7.5? It is because the labor force is shrinking, that's how. If you divide the number of workers working by an ever decreasing number of total workers, you will get the impression that the %employment is increasing. In actual fact, the number of the work force working is decreasing.

The FED is getting set to continue expanding the money supply and Central Banks are still buying gold. Gold prices are kept low by big sales of paper gold, i. e. gold that exists on paper. We know, for example, that Germany's gold has been leased out for just such a purpose. Bernanke will outdo himself printing in hopes of countering the negative effects of rising taxes and continued spending. He will fail.

Friday, December 7, 2012

Weiss Research doubles down.

Weiss Research has released a video that has awesome predictions:

1. Obama's re-election was predicted.

2. No matter how the Fiscal Cliff is resolved US debt will continue to pile up.

3. It will take financial collapse for Washington to react (like curb spending).

4. Giant roller coaster: first deflation then inflation.

5. Bernanke will print more to sustain economy. He will fail.

6. Money printing will continue and accelerate.

7. Printed money will drive prices. Will decimate the US Dollar.

8. Bond prices will collapse.

9. Gold will end up at 6,000, silver at 150 and oil at 200/bbl.

10. US Dollar will spike then resume its slide.

Where are we? The US Dollar rallies then stops. Gold and silver drop then recover. There are signs that some miners are ready to pop (reverse head and shoulder). The Chinese are accelerating gold mining and importing gold.

1. Obama's re-election was predicted.

2. No matter how the Fiscal Cliff is resolved US debt will continue to pile up.

3. It will take financial collapse for Washington to react (like curb spending).

4. Giant roller coaster: first deflation then inflation.

5. Bernanke will print more to sustain economy. He will fail.

6. Money printing will continue and accelerate.

7. Printed money will drive prices. Will decimate the US Dollar.

8. Bond prices will collapse.

9. Gold will end up at 6,000, silver at 150 and oil at 200/bbl.

10. US Dollar will spike then resume its slide.

Where are we? The US Dollar rallies then stops. Gold and silver drop then recover. There are signs that some miners are ready to pop (reverse head and shoulder). The Chinese are accelerating gold mining and importing gold.

Wednesday, December 5, 2012

Gold price: not the same old?

As the international economic situation worsens and financials unravel, it is getting harder to predict the Markets. And without predictability, it is getting harder to make rational decisions. The hardest place is the Gold and Silver Markets. Consider Weiss Research. It has Larry, who predicts that gold will fall to 1,400 before it rallies to 6,000 and Sean, who predicts that gold is going to start a strong rally, now. To complicate matters, WR picked up a guy who is predicting gold will fall to $750. How is that for inconsistency?

So, we are not surprised by the latest happenings, are we? Gold price was attacked on Wednesday by the same old big SELL orders and it dropped $35. Monday, the attack continued, dropping gold below 1,700 again. Larry's prediction coming true? Nope. The Dollar Index fall substantially below 80 and gold recovered last night and is once again above 1,700.

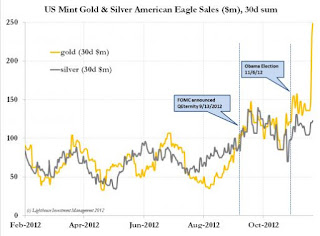

One possible new factor is the sale of PM coins by the Mint.

So, we are not surprised by the latest happenings, are we? Gold price was attacked on Wednesday by the same old big SELL orders and it dropped $35. Monday, the attack continued, dropping gold below 1,700 again. Larry's prediction coming true? Nope. The Dollar Index fall substantially below 80 and gold recovered last night and is once again above 1,700.

One possible new factor is the sale of PM coins by the Mint.

Tuesday, December 4, 2012

Attention turns to Spanish banks.

The bad news from Spain is like the rain in Noah's time: wet, wet, wet. Unemployment has inched up close to 5 million and government cash receipt from taxes is falling. That means that the Spanish government is selling bonds to finance its spending. Spain needs some kind of bailout, but so far this has been avoided.

Amidst all this bad news the bailout of Spanish banks is beginning in earnest. The reports are sketchy, but several banks are being given loans to the tune of E60B, including the four banks already nationalized. The official story is that Spain's own housing bubble has buried the banks in non-performing loans.

Along the bailouts come conditions and dictates. Spanish banks are to downsize the number of branches,lay off employees (further exacerbating unemployment), stop lending for housing and make loans to industry. Once such tinkering begins there is just no end to it. And the Spanish economy continues to shrink.

Amidst all this bad news the bailout of Spanish banks is beginning in earnest. The reports are sketchy, but several banks are being given loans to the tune of E60B, including the four banks already nationalized. The official story is that Spain's own housing bubble has buried the banks in non-performing loans.

Along the bailouts come conditions and dictates. Spanish banks are to downsize the number of branches,lay off employees (further exacerbating unemployment), stop lending for housing and make loans to industry. Once such tinkering begins there is just no end to it. And the Spanish economy continues to shrink.

Monday, December 3, 2012

Larry about the proposed tax hikes.

|

|

Before I get to my analysis of the key markets, today I want to digress a bit and discuss what I call the “idiocy of raising taxes.”

Especially taxes on dividends. It offers a great example of how raising taxes can backfire, and how Washington’s bureaucrats don’t have a clue about what they’re doing.

Consider the various economic gurus who say raising taxes on dividends and capital gains won’t impact investor behavior or the economy. That’s pure hogwash.

To see why, just consider the companies that are busy cashing out their investments ahead of a tax hike January 1 ...

Costco (COST), the giant wholesaler, announced Wednesday that it will pay a special dividend of $7 a share — or $3 billion in total cash — before the end of the year. As a result, Costco shareholders will only pay the current 15% tax on dividends, rather than the 39.6% rate scheduled to kick in next year.

That represents a tax savings of $738 million for Costco shareholders, 24.6% less taxes they have to pay on the $3 billion payout.

Or put another way, it’s $738 million the U.S. Treasury will NOT get.

Costco isn’t the only company cashing out before year-end. According to the Wall Street Journal, as of last Wednesday, 173 companies had announced special dividends, compared to only 72 in the same period a year ago.

In the Russell 3000 Stock Index, from just September to mid-November, 59 companies declared one-time special dividends, four times last year’s pace.

Howard Silverblatt of S&P Dow Jones Indices stated, “I find no precedent like this at all going all the way back to the 1950s.”

Wal-Mart (WMT) did the same thing last week, moving up its expected $1.34 billion dividend payout next year to this year. That’s another $319 million the Treasury won’t get.

And mind you, the figures above don’t even include the 3.8% ObamaCare surcharge that households making more than $250,000 next year will save by getting their dividends this year.

You can bet that many more companies will be doing the same in the days and weeks ahead, accelerating next year’s dividend payouts to this year.

And it’s all money the U.S. Treasury will NOT get as a result.

Moreover, the long-term consequences of a higher dividend tax starting in January will be that fewer and fewer companies will pay dividends at all, while others will reduce their payouts.

Which again, all translates into less money for the U.S. Treasury, precisely the opposite of what it wants.

Consider history. According to the Wall Street Journal, dividend payouts rose only modestly in the 1980s and 1990s when they were taxed as ordinary income.

But when the Bush tax cut chopped the rate to 15% on January 1, 2003, dividends reported on tax returns nearly doubled to $196 billion in 2003 from $103 billion in 2002.

By 2006, reported dividend income hit $337 billion — more than three times the pre-tax-cut level.

In other words, when tax rates were cut, the Treasury received more tax income. If they are raised, the Treasury will get LESS tax receipts.

You don’t need to be a rocket scientist to figure it out. Raising taxes, in any form in my opinion, is pure idiocy.

When the capital gains rate last rose, to 28% from 20% as part of the 1986 tax reform, investors also cashed in before the higher rate took effect.

Tax revenue from capital gains in 1986 soared to $52.9 billion, then plunged to $33.7 billion in 1987 and stayed largely flat for nearly a decade. It boomed again after Bill Clinton and Newt Gingrich agreed to return the rate to 20% in 1997.

Again, it’s a simple formula: When government raises taxes on dividends and capital gains, it lowers the after-tax return on stocks.

That in turn reduces the wealth in the private economy. And not just among the rich. It will affect almost everyone.

It’s also why I remain largely bearish most markets in the short- to intermediate-term.

The Dow is hovering below important resistance at the 13,400 level, and looking like it’s about to break down. Ditto for the S&P 500.

Gold is starting to weaken again, unable to take out resistance at the $1,755 to $1,760 level. A break of the $1,700 level should lead to new lows.

Oil is having trouble at the $90 level. Look for it to top out soon and head back down.

Silver is going to hit a stiff wall of resistance at the $34 to $35 level and a plunge down to $26 — and lower — is still in the cards.

Bottom line: Don’t be surprised when you see Washington’s tax receipts plummet next year and the deficit widen and the national debt get worse. The idiots in Washington, again, just simply do not have a clue what they are doing.

ALL of this virtually guarantees that 2013 will be the wildest ride any of us has ever seen.

Theory and practice.

'In theory there is no difference between theory and practice. In practice, there is.' This quote is attributed to to (who else?) Yogi Berra.

This is to introduce the "Laffer Curve" that plots the relationship between tax rate and the money brought in at a specified rate. The LC predicts a maximum revenue at some tax rate and an actual decrease if the tax rate is raised.

Leftists do not believe in the Laffer Curve and believe that there is a linear relationship between tax rate and what revenue the tax rate brings in. They refer to the Laffer Curve and revenue as "voodoo economics." Actually, the Laffer Curve works.

The Socialist-led govt of the State of Maryland changed taxes from 4.75% to 6.25% for people earning over $1M/yr. Revenue in this category fell $1.7B/y. The British govt of Socialist Brown changed tax rates from 40% to 50% for people earning over a million pounds/yr (2010). Not surprisingly to us, the number of people who fell into this category went from 16,000 to 6,000. Now that the Brits have changed income tax rates back to 45%, the number of people reporting more than 1M lb/yr income has gone back up to 10,000.

Barak Hussein Obama and his fellow Democrats want to "resolve" the financial cliff by increasing the TAX RATE on the top 2% of earners in this country. The lame-brain leadership of the GOP wants to resist that but provide other "revenue enhancements.' It is a teachable moment. Boehner and co could point out that raising the tax rates reduces revenue. He could point to the examples where figures actually show it is as we say. But the Republican establishment is quiet and leaves the field to the demagoguery of the Socialists (called Democrats). And Barak Hussein wants the highest earners punished for their success, consequences be damned.

This is to introduce the "Laffer Curve" that plots the relationship between tax rate and the money brought in at a specified rate. The LC predicts a maximum revenue at some tax rate and an actual decrease if the tax rate is raised.

Leftists do not believe in the Laffer Curve and believe that there is a linear relationship between tax rate and what revenue the tax rate brings in. They refer to the Laffer Curve and revenue as "voodoo economics." Actually, the Laffer Curve works.

The Socialist-led govt of the State of Maryland changed taxes from 4.75% to 6.25% for people earning over $1M/yr. Revenue in this category fell $1.7B/y. The British govt of Socialist Brown changed tax rates from 40% to 50% for people earning over a million pounds/yr (2010). Not surprisingly to us, the number of people who fell into this category went from 16,000 to 6,000. Now that the Brits have changed income tax rates back to 45%, the number of people reporting more than 1M lb/yr income has gone back up to 10,000.

Barak Hussein Obama and his fellow Democrats want to "resolve" the financial cliff by increasing the TAX RATE on the top 2% of earners in this country. The lame-brain leadership of the GOP wants to resist that but provide other "revenue enhancements.' It is a teachable moment. Boehner and co could point out that raising the tax rates reduces revenue. He could point to the examples where figures actually show it is as we say. But the Republican establishment is quiet and leaves the field to the demagoguery of the Socialists (called Democrats). And Barak Hussein wants the highest earners punished for their success, consequences be damned.

The Greek defaults.

In my last post on this subject (The Greek Soap Opera) I have alluded to the possibility that the latest changes in Greek loan terms constituted a partial default.

\

In a post dated for today Michael Pento (KINGWORLDNEWS.COM) details the conditions of the defaults.

I. First default.

E172B of Greek bonds in private hands, constituting 85.5% of the total bonds in private hands, were defaulted upon. This was called the "haircut" as you remember.

II. Second default.

This was the changing of interest rate, maturity and the 10 year deferral of interest payments. The default refers to bonds held in banks.

A third default is promised of some E40B.

All theses defaults constitute what the EU leadership referred to as "managed default." Inasmuch as Greece is unable and unwilling to do away with the conditions of Social Democracy that led to the huge debt, Greece had to reduce payments to people, in fact reduce living standards.

\

In a post dated for today Michael Pento (KINGWORLDNEWS.COM) details the conditions of the defaults.

I. First default.

E172B of Greek bonds in private hands, constituting 85.5% of the total bonds in private hands, were defaulted upon. This was called the "haircut" as you remember.

II. Second default.

This was the changing of interest rate, maturity and the 10 year deferral of interest payments. The default refers to bonds held in banks.

A third default is promised of some E40B.

All theses defaults constitute what the EU leadership referred to as "managed default." Inasmuch as Greece is unable and unwilling to do away with the conditions of Social Democracy that led to the huge debt, Greece had to reduce payments to people, in fact reduce living standards.

Subscribe to:

Posts (Atom)