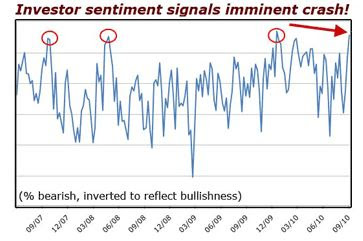

My favorite guru uses the cycle theory to predict movement in PM prices (gold and silver prices). According to him, the PM market is due for a steep correction. How steep? He pegs gold to go back to 1,350 (maybe even a hundred lower) and silver correcting back to maybe as low as $22/oz. Then he made a strange statement. Unless silver corrects back, it won't move beyond $30.

My favorite guru uses the cycle theory to predict movement in PM prices (gold and silver prices). According to him, the PM market is due for a steep correction. How steep? He pegs gold to go back to 1,350 (maybe even a hundred lower) and silver correcting back to maybe as low as $22/oz. Then he made a strange statement. Unless silver corrects back, it won't move beyond $30.I am not privy to his formulas. He was correct in his long range forecast, but he keeps repeating the forecast for the steep drop. So far, it has not happened. But it could happen. Still, forecasters should do like weathermen and look out the window.

I have collected silver and gold prices that go back to August this year. Both graphs show an almost straight line change till mid October then volatility increases. Furthermore, the rate of change of gold prices slowed, while silver prices continued. Is this meaningful?

Let's look at the fundamentals then. 1. The European debt crisis continues and if the papering over shows cracks, Europeans will again buy dollars which might drop gold prices for a while. 2. The FED is continuing the printing of money. Of course, the printing has been reduced to punching computer keys, but the result is the same, adding money to the money supply. Potentially, this could be as much as $6T or even more. 3. The fundamentals of the US economy are being still devastated by Obama and the Democrats. The latest example is the political maneuvering over the expiration of tax rates in place since 2003. Obama refers to efforts to maintain this level of taxation as "tax cuts for the rich." In what has been dubbed as an abrupt about face, Obama agreed to an extension of these rates for two years in exchange for extending unemployment and reducing Social Security witholdings. Some people believe that Obama was setting up a hoax in order to discredit supply-side economics. The idea that maintaining the same tax rates is a "tax cut" is a hoax, since there is no change from the current level of taxation, except that inheritance taxes will go from zero to thirty five percent. In any case, members of the Socialist Party (Democrats) reacted violently and the Dem caucus in the House has voted to defy Obama. So, here we are facing the Dec 15 witching hour. Will people dump stocks (including PM miners) anticipating a rise in taxes on cap gains?

So, while technicals do not forecast a drop in gold prices, fundamentals are uncertain. The feeble attempt by Obama to try to emulate Bill Clinton's move to the mythical "Center" is a sham. He remains a Marxist and a foe of Capitalism.

All this uncertainty is having a good effect: the Dem's Dream Act of registering millions of Hispanic Democrats has been shelved by the Senate along with the repeal of "don't ask don't tell." At least for the while. Dingy Harry Reid is a treacherous bas...d and can renag on promises at a drop of a hat.

So, here we are. Will we see a drop in gold?