Every time gold prices take a correction, we hear the chorus that we are in a gold 'bubble" that is about to burst. The chorus continues until the correction is over, abates, then restarts when gold takes its next drop. The chorus is even louder when it comes to silver prices.

The first graphic purports to show a "parabolic" rise in silver, the final proof of a bubble in some eyes. When I get a plot for silver prices, the price rise is steep but not parabolic(second graph down). Even more revealing is the third graph, the gold price. Since, last November, gold has traded in a rising channel. No runaway bubble there. Compare the rise in gold prices to the previous graph: while gold has started the current channel in November, the rise in silver began in August this year. Until then, shorts were keeping silver prices almost even. So, now silver prices are pushing hard. Also, the occurrence of silver to gold is 14 to 1 in the ground, so for many years gold ran 15 times higher than silver. The ratio of gold to silver got as high as 60. Clearly, silver prices were being suppressed.

The biggest reason for the rise in precious metals is the money printing across the world, especially in Europe and the US and Japan. Yes, we have a fear of inflation as well, but it is the Central Banks and our FED that are ruining the fiat currencies.

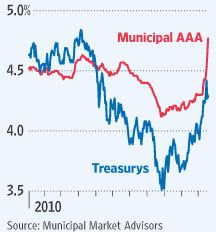

The FED is starting QEII with a 600 Billion purchase of Treasuries that is supposed to goose the economy and lower interest rates. Instead, we see municipal and Treasury bonds yielding more in interest, forced on the bond issuers, because of the value of the Dollar is dropping. Strange that Helicopter Ben is still 'surprised' every time one of his schemes do not work out.

The last graphics is a description of what happens in a gold bubble. We have yet to see the Public become enthusiastic.

The best guesstimate is that gold will reach $5,000/oz between now and next August. Sometime, between now and then, gold will start moving fast. The current rally is small potatoes.

No comments:

Post a Comment