2013 will be an extraordinary confluence of wrong thinking and financial mistakes. Government interference with markets is growing and this is creating great economic and financial strains.

EUROPE.

We have already read about the financial turmoil in Greece, Ireland, Portugal, Spain and Italy, but now we add one more to this toxic brew: France. The election of a Socialist government ensures that financial common sense will leave the Gallic shores. Sure enough, the French tried to raise confiscatory taxes on top earners, causing an exodus of capital, along with those who earn it. While, a French court struck down the infamous 75% tax on incomes above E1M/yr, this just adds to the confusion. What's the problem? French banks, you see, are an important linch pin in world trade and with France increasingly vulnerable to the stupidities that plague Socialist countries, the reputation of these banks is suffering. You will hear more of this as the trend unfolds.

JAPAN.

Japan has elected a government that promised to print money to reduce the value of the YEN. The stupids that now run the country believe that destroying the value of their currency will help export and thus, their economy. Japan's PM Abe is on board with this and so is their Finance Minister Aso. What these people do not realize is that a cheaper currency might help exports, but it makes imports more expencive. And Japan imports a lot of things, including oil. With their atomic power still in the dog house, Japan must import more oil.Also, Japanese banks are also involved in financing international trade and a falling currency will hurt these banks. Japan has a shrinking population, hence their push for robotics.

THE UNITED STATES.

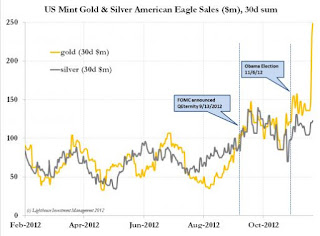

Unfortunately, the US has also fallen into the category of countries where stupidity had overtaken the population. BHO and the Democrats had solidified their hold on America, which is bad news for the Country and the economy. The Fisal Cliff will send us deeper into economic stagnation. US credit rating will suffer and we will slip into recession. Bernanke will increase printing, but without increasing money velocity, the printing will heve little beneficial effect. If Larry is correct, gold will resume its climb as investment opportunities grow scarce.

ATHENS, Greece (AP) — A sign taped to a wall in an Athens hospital appealed

for civility from patients. "The doctors on duty have been unpaid since May," it

read, "Please respect their work."

Patients and their relatives glanced up briefly and moved on, hardened to

such messages of gloom. In a country where about 1,000 people lose their jobs

each day, legions more are still employed but haven't seen a paycheck in months.

What used to be an anomaly has become commonplace, and those who have jobs that

pay on time consider themselves the exception to the rule.

To the casual observer, all might appear well in Athens. Traffic still hums

by, restaurants and bars are open, people sip iced coffees at sunny sidewalk

cafes. But scratch the surface and you find a society in free-fall, ripped apart

by the most vicious financial crisis the country has seen in half a century.

It has been three years since Greece's government informed its fellow members

in the 17-country group that uses the euro that its deficit was far higher than

originally reported. It was the fuse that sparked financial turmoil still

weighing heavily on eurozone countries. Countless rounds of negotiations ensued

as European countries and the International Monetary Fund struggled to determine

how best to put a lid on the crisis and stop it spreading.

The result: Greece had to introduce stringent austerity measures in return

for two international rescue loan packages worth a total of €240 billion ($313

billion), slashing salaries and pensions and hiking taxes.

The reforms have been painful, and the country faces a sixth year of

recession.

Life in Athens is often punctuated by demonstrations big and small, sometimes

on a daily basis. Rows of shuttered shops stand between the restaurants that

have managed to stay open. Vigilantes roam inner city neighborhoods, vowing to

"clean up" what they claim the demoralized police have failed to do. Right-wing

extremists beat migrants, anarchists beat the right-wing thugs and desperate

local residents quietly cheer one side or the other as society grows

increasingly polarized.

"Our society is on a razor's edge," Public Order Minister Nikos Dendias said

recently, after striking shipyard workers broke into the grounds of the Defense

Ministry. "If we can't contain ourselves, if we can't maintain our social

cohesion, if we can't continue to act within the rules ... I fear we will end up

being a jungle."

CRUMBLING LIVING STANDARDS

Vassilis Tsiknopoulos, runs a stall at Athens' central fish market and has

been working since age 15. He used to make a tidy profit, he says, pausing to

wrap red mullet in a paper cone for a customer. But families can't afford to

spend much anymore, and many restaurants have shut down.

The 38-year-old fishmonger now barely breaks even.

"I start work at 2:30 a.m. and work 'till the afternoon, until about 4 p.m.

Shouldn't I have something to show for that? There's no point in working just to

cover my costs. ... Tell me, is this a life?"

The fish market's president, Spyros Korakis, says there has been a 70 percent

drop in business over the past three years. Above the din of fish sellers

shouting out prices and customers jostling for a better deal, Korakis explained

how the days of big spenders were gone, with people buying ever smaller

quantities and choosing cheaper fish.

Private businesses have closed down in the thousands. Unemployment stands at

a record 25 percent, with more than half of Greece's young people out of work.

Caught between plunging incomes and ever increasing taxes, families are finding

it hard to make ends meet. Higher heating fuel prices have meant many apartment

tenants have opted not to buy heating fuel this year. Instead, they'll make do

with blankets, gas heaters and firewood to get through the winter. Lines at soup

kitchens have grown longer.

At the end of the day, as the fish market gradually packed up, a beggar

crawled around the stalls, picking up the fish discarded onto the floor and into

the gutters.

"I've been here since 1968. My father, my grandfather ran this business,"

Korakis said. "We've never seen things so bad."

Tsiknopoulos' patience is running out.

"I'm thinking of shutting down," he said, "I think about it every day. That,

and leaving Greece."

JUSTICE

On a recent morning in a crowded civil cases court in the northern city of

Thessaloniki, frustration simmered. Plaintiffs, defendants and lawyers all

waited for the inevitable — yet another postponement, yet another court

date.

Greece's sclerotic justice system has been hit by a protracted strike that

has left courts only functioning for an hour a day as judges and prosecutors

protest salary cuts.

For Giorgos Vacharelis, it means his long quest for justice has grown longer.

Vacharelis' younger brother was beaten to death in a fairground in 2003. The

attacker was convicted of causing a fatal injury and jailed. The family felt the

reasons behind the 24-year-old's death had never been fully explained, and filed

a civil suit for damages. Nearly 10 years later, Vacharelis and his parents had

hoped the case would finally be over.

But the court date they were given in late September got caught up the

strike. Now they have a new date: Feb. 28, 2014.

"This means more costs for them, but above all more psychological damage

because each time they go through the murder of their relative again," said

Nikos Dialynas, the family's lawyer.

Vacharelis and his family are in despair.

"If a foreigner saw how the justice system works in Greece, he would say

we're crazy," said the 35-year-old.

"Each time we come to court we get even more outraged," he said. "We see a

theater of the absurd."

VIGILANTES

In September, gangs of men smashed immigrant street vendors' stalls at fairs

and farmers' markets. Videos posted on the Internet showed the incident being

carried out in the presence of lawmakers from the extreme right Golden Dawn

party. Formerly a fringe group, Golden Dawn — which denies accusations it has

carried out violent attacks against immigrants — made major inroads into

mainstream politics. It won nearly 7 percent of the vote in June's election and

18 seats in the 300-member parliament. A recent opinion poll showed its support

climbing to 12 percent.

Immigrant and human rights groups say there has been an alarming increase in

violent attacks on migrants. Greece has been the EU's main gateway for hundreds

of thousands of illegal migrants — and foreigners have fast become scapegoats

for rising unemployment and crime.

While there are no official statistics, migrants tell of random beatings at

the hands of thugs who stop to ask them where they are from, then attack them

with wooden bats.

Assaults have been increasing since autumn 2010, said Spyros Rizakos, who

heads Aitima, a human rights group focusing on refugees. Victims often avoid

reporting beatings for fear of running afoul of the authorities if they are in

the country illegally, while perpetrators are rarely caught or punished even if

the attacks are reported.

"Haven't we learned anything from history? What we are seeing is a situation

that is falling apart, the social fabric is falling apart," Rizakos said. "I'm

very concerned about the situation in Greece. There are many desperate people

... All this creates an explosive cocktail."

In response to pressure for more security and a crackdown on illegal

migration, the government launched a police sweep in Athens in early August. By

late October, police had rounded up nearly 46,000 foreigners, of whom more than

3,600 were arrested for being in the country illegally.

Police say that in the first two months of the operation, there was also a 91

percent drop in the numbers of migrants entering the country illegally along the

northeastern border with Turkey, with 1,338 migrants arrested in the border area

compared to 14,724 arrested during the same two months in 2011.

HEALTHCARE

At a demonstration by the disabled in central Athens, tempers were

rising.

Healthcare spending has been slashed as the country struggles to reduce its

debt. Public hospitals complain of shortages of everything from gauzes to

surgical equipment. Pharmacies regularly go on strike or refuse to fill

subsidized social security prescriptions because government funds haven't paid

them for the drugs already bought. Benefits have been slashed and hospital

workers often go unpaid for months.

And it is the country's most vulnerable who suffer.

"When the pharmacies are closed and I can't get my insulin, which is my life

for me, what do I do? ... How can we survive?" asked Voula Hasiotou, a member of

an association of diabetics who turned out for the rally.

The disabled still receive benefits on a sliding scale according to the

severity of their condition. But they are terrified they could face cuts, and

are affected anyway by general spending cuts and the pharmacy problems.

"We are fighting hard to manage something, a dignified life," said Anastasia

Mouzakiti, a paraplegic who came to the demonstration from the northern city of

Thessaloniki with her husband, who is also handicapped.

With extra needs such as wheelchairs and home help for everyday tasks such as

washing and dressing, many of Greece's disabled are struggling to make ends

meet, Mouzakiti said.

"We need a wheelchair until we die. This wheelchair, if it breaks down, how

do we pay for it? With what money?"

___

Costas Kantouris in Thessaloniki, Greece contributed to this story.

-----------------------------------------------------------------------------------

That's where we head under Obama.