The financial world has been so skewed by central bankers that it is in danger of ...what? Consider the following reports:

The financial world has been so skewed by central bankers that it is in danger of ...what? Consider the following reports:1. In spite of large amounts of paper currency, gold prices are holding steady;

2. The evidence of manipulation of gold prices is now irrefutable;

3. Precious metal miners have been shorted into oblivion;

4. The amount of paper gold traded in London and the COMEX in ONE YEAR is 120 times the gold production of the last 50 years;

5. Gold is being sold short by people far in excess of the amount of gold available;

6. Some physical gold delivered in Asia turned out to be tungsten coated with gold;

7. The FED refuses to allow the gold at Fort Knox to be audited or tested.

So, what does this all add up to?

The price of commodities is being held back by the manipulation of the gold price, which creates an artificially low inflation. The cost of that is unknown, but is estimated in excess of a trillion dollars. The artificially low commodity prices are slowing the economy, because it counters the expected effect of injected money. This is being financed by the FED buying Treasuries. The FED already printed 3 Trillion dollars just to rescue European banks in 2008-9 and is on track to print another 3 Trillion this year. Europe has to roll over 3.4T worth of bonds this year and they do not have the money.

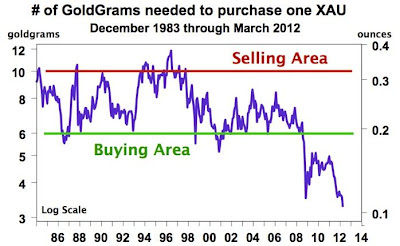

How long can the Central Banks wind the distortion in commodity and gold prices? That is the question. Some people prattle about gold being in a bubble, most feel that the FED is slowly losing control. And that's the Pundits. The Public knows little.

So, the tension of gold rising is like a spring being compressed. The more it is wound, the higher it will go when it unwinds.

No comments:

Post a Comment