"When some weathermen predict rain and others predict sunshine, it behooves the prudent man to keep an eye on the sky and on the radar, if available." Geezer Bela in Exile

Larry is a superb technician and he does rely on formulas that DO work, so his predictions should not be dismissed out of hand. Still, there are those other experts on KWN and they are not chopped liver, either. Louise Yamada likes the bull market for gold and silver, though she does not like the miners. Rob Arnott warns of tremendous inflation coming. And Robin Griffith says: "only a fool would short gold here." Larry recommends using a double short fund to protect current holdings.

IMHO, the divergence of opinion reflects the volatility in the Markets, which is another way of saying that there is a lot of uncertainty. As I write this, the price of silver is at 40 and gold is at 1,800. Both were a bit lower earlier. Gold has a support at 1,780 and silver at 39. So much for the radar.

Now for the look at the charts.

Silver is still increasing so its 50 DMA increases faster than the 200 DMA. Gold, on the other hand, is still increasing so that its 50 DMA parallels its 200 DMA and both are rising consistently.

Could Larry be correct that if/when the Stock Market retreats, people will dump their gold and silver for cash, as they did in 2008? Not likely, say experts on KWN. We face a different situation now. In 2008, the money circulation was virtually stopped when the FED imposed "mark to market" and people needed cash. Now, people are liquid.

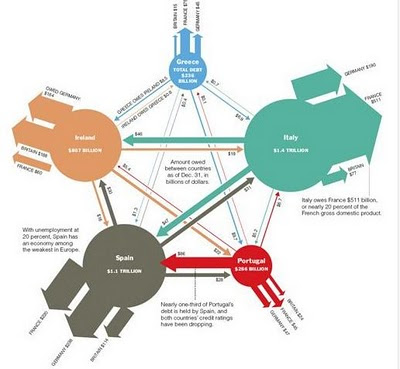

Larry's formulas predicted that when the Stock Market will tank, gold and silver (and the miners) will not. He now conveniently ignores this earlier prediction. Something else that Larry ignores. The Greek "crises" is ON/OFF as their cash allotment is held up. There is no reason for Greece to default. Neither is there certainty that the US will have a double dip recession. Central banks can postpone these events by printing more money. True, that will not solve the long-term problem (governments spend too much and capital formation is inhibited by high taxes), but government can BELIEVE that more printing of money will do the trick. And that means that precious metals will keep rising in terms of currency. So, the argument is what happens if there is a sell off on Wall Street.

There are a number of questions re gold that we need to answer now. Perhaps, the most important one is: 1. is the correction over? I have used the graph of GLD as well as gold itself to try to answer this question.

There are a number of questions re gold that we need to answer now. Perhaps, the most important one is: 1. is the correction over? I have used the graph of GLD as well as gold itself to try to answer this question.