Can you hear the foot steps? It is the chickens coming home to roost in Europe. Secretary of the Treasury Geithner flew to a meeting in Wroclaw, Poland and told the European finance ministers to do what the US does: have the Central Bank hand a check to member banks and tell them to tack on a zero - Geithner calls that "leverage." It is counterfeiting on a grand scale.

Can you hear the foot steps? It is the chickens coming home to roost in Europe. Secretary of the Treasury Geithner flew to a meeting in Wroclaw, Poland and told the European finance ministers to do what the US does: have the Central Bank hand a check to member banks and tell them to tack on a zero - Geithner calls that "leverage." It is counterfeiting on a grand scale. But, Europe is not the US! The EU has several countries (17) and they all need to be consulted. And they all have different level of interests, different ways of looking at things.

This is the week when the chickens may find their coop. It is a busy weak: 1. the IMF meets; 2. the FED meets and is expected to agree on a new twist to things (essentially manipulate long term interest rates to reduce them); and 3. the European finance ministers meet to decide on whether to release Greece's next allotment of cash.

Can you hear the clucking?

The Financial Times of London described the different scenarios of a Greek default(first three graphs). The written text following (and you may need a magnifier glass to read this) shows the actual events that took place in Argentina after it defaulted. The events were very traumatic for the middle class.

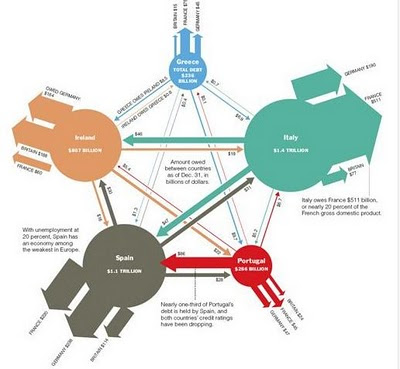

It would be very comforting to know that the Europeans worry about the people of Greece and try to stave off default for that reason. The truth is that Europeans worry about "contagion." Contagion, like quantitative easing, is a code word used to cover up what really goes on. In the case of "contagion," it refers to the check kiting that went on between European banks to allow governments to engage in deficit spending without admitting it. The next to last chart shows the tangled cross borrowing by European countries and their Central Banks. If Greece defaults, the European banks would have to write off a lot of their assets and they are close to bankrupt as is. Of course, the Europeans can do what banks do when dealing with fiat currency: print more.

At present, Europeans are trying to dump the Euro and buying US Dollars. That is why the Dollar is rising in value. The last graph shows us the resistance of the Dollar to buying pressure. Bernanke does not want the Dollar to rise; in fact he wants the opposite.

One might ask what brought Europe to this state. The application of Social Democracy is certainly a major factor, but the Greens is another significant factor. "Greens" means higher energy costs and higher costs in manufacturing. Governments borrowed money to maintain "benefits." And Europe is running out of other people's money to redistribute.

No comments:

Post a Comment