Headlines in Italy say it all: INGOVERNIBILITA, NERVOSISMO, MIRACOLO BERLUSCONI.

The actual count puts the Center left coalition slightly ahead in the lower house, which by law awards them 54% of the vote. In the upper house, the representation is awarded on a regional basis and the center left has only a very narrow win. What does this mean?

Lets start by stating that technically, the center left could form a government based on just numbers if the coalition held together. Based on past experience, such governments do not last long.

A broader coalition? Who and how? Mario Monti's party got shellacked with 10% of the vote, besides, Monti is the architect of Italian austerity and center left wants to loosen the austerity. Beppo is more of a comic than politician and his platform is that the people should send everyone home and elect his bunch. Berlusconi? Center left is not keen on the idea and the Italian Media wants a Center left, not a Center Right.

Where does this leave Italy? Everyone is having meetings to figure things out. Then they will proceed to bargaining. And then they will cobble together a government. When? Two weeks is the best guess.

What about the future direction of Italy? The outcome is uncertain. There is a good chance that a weak coalition might be formed that will endure for a time. Such a coalition would want to reduce the austerity, which would increase the deficit. (At the very least, Italian bond rates now will increase at least for a while.) Such a coalition would be hard to form and even harder to maintain; hence the ingovernibilita. Will this take Italy out of the Euro sphere? That's the NERVOSISMO.

Wednesday, February 27, 2013

Tuesday, February 26, 2013

Why the fret about Italy?

John O'Sullivan describes the results of the Italian elections thus (Monday night):

"

If the results hold up as expected some serious repercussions are possible. Don't expect the Italians to be worried though. They are used to weak governments which only last a short time. It is the rest of Europe which has much to fear. Why? Berlusconi's Party has campaigned against austerity and so did Beppe Grillo. If the two parties form a coalition, they might just destabilize the EU enough to take Greece and Spain as well as Italy out of the EU and German domination. What are the odds? Grillo is no fan of Berlusconi, so if there is a coalition, it must be led by someone other than Bunga bunga. Berlusconi has already agreed. Grillo is a "moderate" (meaning leans to the Left but does not want to be part of it) and the fate of the EU falls on his shoulders. If he joins Bersani, austerity remains in place and Grillo would accept what he campaigned against and what gave a reason for his Party to exist. We live in interesting times. The Eurocrats hope that they will prevent a center right coalition and force a redo as they did in Greece. What is the chance that any coalition will work and rescue Italy? SLIM TO NONE. Italy needs to privatize, become more efficient and shrink the Government. It's not gonna happen.

"

"Italy’s full election results will not be known until tomorrow morning, but their broad outline is already clear. The two large coalitions of left and right are about equal; the center Left Olive Tree coalition leads the center-right House of Freedom by two percent and shrinking. The much-touted centrist party, led by “technocrat” Mario Monti but backed by Angela Merkel and the European Union, received between 10 and 11 percent of the vote. And the left-right populist coalition headed by comedian Beppe Grillo won a quarter of the votes and is now in the position of kingmaker that Monti’s party was (quite confidently) aiming at.

Another way of looking at these results is that they amount to a strong recovery by former prime minister Silvio Berlusconi; a disappointment for the center-left’s Pier Luigi Bersani, who expected a solid win; and a severe defeat for Monti (who, after all, was prime minister a few weeks ago); and a humiliation for Germany’s Angela Merkel, who more or less dismissed Berlusconi and appointed Monti in his place to ensure that Italy followed Berlin’s policy of economic austerity in defense of the euro."If the results hold up as expected some serious repercussions are possible. Don't expect the Italians to be worried though. They are used to weak governments which only last a short time. It is the rest of Europe which has much to fear. Why? Berlusconi's Party has campaigned against austerity and so did Beppe Grillo. If the two parties form a coalition, they might just destabilize the EU enough to take Greece and Spain as well as Italy out of the EU and German domination. What are the odds? Grillo is no fan of Berlusconi, so if there is a coalition, it must be led by someone other than Bunga bunga. Berlusconi has already agreed. Grillo is a "moderate" (meaning leans to the Left but does not want to be part of it) and the fate of the EU falls on his shoulders. If he joins Bersani, austerity remains in place and Grillo would accept what he campaigned against and what gave a reason for his Party to exist. We live in interesting times. The Eurocrats hope that they will prevent a center right coalition and force a redo as they did in Greece. What is the chance that any coalition will work and rescue Italy? SLIM TO NONE. Italy needs to privatize, become more efficient and shrink the Government. It's not gonna happen.

Monday, February 25, 2013

Can the FED retreat?

A little over a week ago, the release of the minutes of the last FOMC meeting helped send equities and commodities plunging. Particularly hard hit were the gold mining stocks. First reports were that the BIS was responsible for this latest takedown of the gold price.

In the present post, I would like to examine the broader implications of these events.

Ever since the events of 2008 Sep, the world has been experiencing a fiscal and economic downturn. It began with the decision of the FOMC to switch the accounting system used by the banks (the so-called mark to market). This meant that banks could no longer use their formulas for valuing assets such as real estate or mortgages, but had to use the actual market value. Since, real estate values took a hit because of the sub prime loans, a number of banks were suddenly in trouble.

I managed to find the evidence of a perpetrated plunge in the money velocity and GDP which sent Barak Hussein Obama to the White House (see my July 30, 2009 post). The moves by the FOMC initiated a massive deleveraging and deflation. Ever since that time, the Obama regime has been raising govt spending and trying to force taxes upward. The resultant deficit is being financed by increasing the National Debt.

The FED responded by reducing interest rates and trying to stimulate the economy via increasing the money supply (QE1,2,3 and 4). But, extremely low interest rates are harmful, so the FED has to retreat one of these days, but can it?

Part of the effect of increasing the money supply is an increase in the Stock Market. This increase is supposed to stimulate the economy. And every time the FOMC breathes a hint of retreating from this policy, the markets dive. The question of retreat has been discussed now twice, but it is a bluff. Keynesian economics does not permit the retreat. If we are lucky, we get a President in 2016 who follows the policy of Reagan. This time government spending must really be cut along with regulations. The US must become an oil and gas exporter. Unfortunately, the Democrat Party and the Media oppose this, so for the time being, the Nation will continue on the same failed path. The day is coming very fast when inflation will accelerate.

In the present post, I would like to examine the broader implications of these events.

Ever since the events of 2008 Sep, the world has been experiencing a fiscal and economic downturn. It began with the decision of the FOMC to switch the accounting system used by the banks (the so-called mark to market). This meant that banks could no longer use their formulas for valuing assets such as real estate or mortgages, but had to use the actual market value. Since, real estate values took a hit because of the sub prime loans, a number of banks were suddenly in trouble.

I managed to find the evidence of a perpetrated plunge in the money velocity and GDP which sent Barak Hussein Obama to the White House (see my July 30, 2009 post). The moves by the FOMC initiated a massive deleveraging and deflation. Ever since that time, the Obama regime has been raising govt spending and trying to force taxes upward. The resultant deficit is being financed by increasing the National Debt.

The FED responded by reducing interest rates and trying to stimulate the economy via increasing the money supply (QE1,2,3 and 4). But, extremely low interest rates are harmful, so the FED has to retreat one of these days, but can it?

Part of the effect of increasing the money supply is an increase in the Stock Market. This increase is supposed to stimulate the economy. And every time the FOMC breathes a hint of retreating from this policy, the markets dive. The question of retreat has been discussed now twice, but it is a bluff. Keynesian economics does not permit the retreat. If we are lucky, we get a President in 2016 who follows the policy of Reagan. This time government spending must really be cut along with regulations. The US must become an oil and gas exporter. Unfortunately, the Democrat Party and the Media oppose this, so for the time being, the Nation will continue on the same failed path. The day is coming very fast when inflation will accelerate.

Sunday, February 24, 2013

Gold manipulation continues.

Last week saw gold beaten down to 1,556/oz. The technicals were in favor of a breakout at 1,700. King World News identified the culprit as the Bank of International Settlements that engineered the takedown. These takedowns are getting dangerous as a certain amount of gold metal has to be thrown into the market to make the takedown work. At the rate we are going, China will end up as the holder of most of the gold in the world.

Why is that bad? First, because the Chinese are not exactly the nicest businessmen in the world. Also, once the Dollar is dethroned as the world's reserve currency, printing money will no longer be possible without the consequences of what any other third world country faces.

We are reminded by KWN of what happened the last time a crazy FED printed money:

http://kingworldnews.com/kingworldnews/KWN_DailyWeb/Entries/2013/2/23_Coming_Soon__%2410_Trillion_Of_Yearly_QE_%26_Fantastic_Gold_Chart.html

In 1979, we had a far stronger economy and especially a stronger financial system. Gold shot up to over 800/oz. Volker responded by raising the prime from 10% to 20%. That broke inflation, reduced the gold price and with the tax cuts of RR it ushered in a 20 year secular Bull Market and prosperity that did not end untill the end of Bill Clinton's Presidency.

The Obama regime has weakened our financial system. Even a 10% prime rate would add $1.7T in interest payments, bringing the on book deficit to $3.0T. That means that the US would have to declare bankruptcy or pay for most of its operating budget out of printed money.

Why is that bad? First, because the Chinese are not exactly the nicest businessmen in the world. Also, once the Dollar is dethroned as the world's reserve currency, printing money will no longer be possible without the consequences of what any other third world country faces.

We are reminded by KWN of what happened the last time a crazy FED printed money:

http://kingworldnews.com/kingworldnews/KWN_DailyWeb/Entries/2013/2/23_Coming_Soon__%2410_Trillion_Of_Yearly_QE_%26_Fantastic_Gold_Chart.html

In 1979, we had a far stronger economy and especially a stronger financial system. Gold shot up to over 800/oz. Volker responded by raising the prime from 10% to 20%. That broke inflation, reduced the gold price and with the tax cuts of RR it ushered in a 20 year secular Bull Market and prosperity that did not end untill the end of Bill Clinton's Presidency.

The Obama regime has weakened our financial system. Even a 10% prime rate would add $1.7T in interest payments, bringing the on book deficit to $3.0T. That means that the US would have to declare bankruptcy or pay for most of its operating budget out of printed money.

CO: Secret energy lab spawns million dollar govt employee

By Tori Richards / November 24, 2012 / 527 Comments

GOLDEN, Colo. – The federal government’s dream of a renewable energy empire hinges on a scrubby outpost here, where scientists and executives doggedly explore a

new frontier.

If you live outside Colorado, you probably haven’t heard of the National Renewable Energy Laboratory – NREL for short. It’s the place where solar panels, windmills and corn are deemed the energy source of the future and companies who support such endeavors are courted.

It’s also the place where highly paid staff decide how to spend hundreds of millions in taxpayer dollars.

And the public pays those decision-makers well: NREL’s top executive, Dr. Dan Arvizu, makes close to a million dollars per year. His two top lieutenants rake in more than half a million each and nine others make more than $350,000 a year.

But what is really going on there? Energy expert Amy Oliver Cooke drove out to the site, which looks something like Nevada’s Area 51 with its remote location and forbidding concrete buildings. NREL had started a construction project and Cooke wanted to see for herself. She didn’t get far: a man in an SUV seemingly appeared out of nowhere, stopped her car, and told her to leave.

“A beefy looking fellow told me, ‘It’s top secret,’ said Cooke, director of the Energy Policy Center at the Independence Institute think tank. “I said, ‘I’m a taxpayer and I want to see what you’re building’ and he said it was it was ‘top secret so we can bring Americans a better future.’”

With its bloated budget and overseen by a $533 million a year government-funded management company, Cooke isn’t buying it.

“NREL has given us two of the most significant boondoggles, one of them being ethanol and the other being (bankrupt) Abound Solar,” she said. “They were part of the team that pushed Abound Solar along. In fact, they wrote in March 2011 on their website how proud they were of their role in abound solar.

“Am I impressed with NREL? No, not really,” she said.

NREL’s taxpayer-funded management company has seen its budget more than double since 2006. That’s when one of its most ardent supporters, Rep. Ed Perlmutter D-Lakewood, was first elected to Congress. The lab sits in the middle of his district.

But Perlmutter’s ties go beyond merely promoting green legislation and lobbying his colleagues for NREL funds. He has received $12,670 in campaign contributions from executives of NREL and its management company, MRIGlobal, a company that describes itself as “an independent, not-for-profit organization that performs contract research for government and industry.” Perlmuter’s father has served as a trustee for MRI and MRIGlobal during the past decade. Between 2003 and 2005, Perlmutter was also a trustee. These positions were unpaid.

Perlmutter did not respond to phone calls seeking comment for this story.

FOLLOWING THE MONEY

Funded by the U.S. Department of Energy, NREL started in 1977 as the Solar Energy Research Institute, a Jimmy Carter-era response to the 1973 Mideast oil crisis. Its budget, then about $100 million, was slashed during the Reagan era.

By the time Perlmutter was elected, NREL’s budget was $209.6 million. It increased steadily before ballooning to $536.5, a beneficiary of President Obama’s stimulus plan and a $135 million contract spread out over five years to construct a new science center. Its current $352 million budget is down slightly from last year’s $388.6 million.

From its inception, NREL has been managed by MRIGlobal, back then called the Midwest Research Institute.

To handle lab management, MRIGlobal partnered with Ohio-based Battelle Memorial Institute, which describes itself as “the world’s largest nonprofit research and development organization.” The pair formed Alliance for Sustainable Energy, a separate non-profit in 2008, for the sole purpose of managing NREL and installed NREL’s top executives as its directors.

Despite record federal debt, municipal bankruptcies and a nagging global recession, those executives enjoy pay packages that are out of reach of most Americans who pay their salaries. MRIGlobal and Alliance tax documents obtained by Watchdog show most earned well into six-figures:

In 2010, MRIGlobal’s tax return shows DOE funding of $104.8 million, while Battelle’s tax return reported $4.55 billion in government grants. Its activities included management of five national laboratories (including NREL) and operating as subcontractor at a sixth.

However, at least one expert who has studied NREL doesn’t see any problem with the fact that the agency is overseen by a management company.

“I have no problems with the contractors operating the lab. They would do a much more efficient job than the government,” said Nick Loris, an energy policy analyst with the Heritage Foundation. “It should lower the cost of these projects.”

But what Loris doesn’t like is the entire concept of placing the government in a role of making energy affordable. That should be a job for the private sector.

“It’s not the government’s role to make energy cheaper. There is no reason the taxpayer should subsidize this,” he said. “We’ve seen the failures when the government gets involved in these projects. If they are going to be successful in the marketplace, they wouldn’t need help from the government”

UNSUSTAINABLE LEVELS

In fact, the billions that have been siphoned into renewable energy have yet to produce a fraction of the promised return, Cooke claims.

Solar and wind still remain prohibitively expensive and not viable for general use as are corn and wood chips to fuel cars. Yet NREL labs continue to work to this end. Cooke predicts that numerous taxpayer-subsidized companies will go bankrupt in the coming years just as the overinflated housing market came crashing down.

And it’s not just the money, she said. It’s the environmental threat.

“I’ll tell you what’s pollution,” Cooke said. “It’s solar panels and wind turbines abandoned — things with toxic chemicals in them,” she said. “We don’t know what’s going to happen to these things. What do you do with a farm of abandoned wind turbines that are 500 feet tall?”

Despite its bloated stimulus funding, there are signs of financial trouble at NREL. The company offered to buy out 100 jobs when its budget dropped between 2011 and 2012.

Perlmutter spokeswoman Leslie Oliver expressed concern about the buyouts, calling NREL the nation’s green energy “crown jewel” and a driving economic force, the Denver Post reported.

“What about next year?” Oliver said. “Where does this stop?”

On his website, Perlmutter blamed Republicans for the cuts and claimed NREL generates 5,500 jobs. Its direct workforce is listed at 1,700.

By all accounts, Perlmutter’s relationship with NREL will continue. He spent two years trying to pass legislation to give solar companies a break with bankers before successfully adding the language to the American Clean Energy and Security Act of 2009.

He is co-chairman of the New Democrat Coalition Energy Task Force, part of the Financial Services Committee. Perlmutter has leveraged that role to keep alive a 20-year-old energy tax credit to producers of wind technology.

That credit would have expired at the end of the year. But the Financial Services Committee produced a bill to extend the credit for another year, which carries a cost of $12 billion over the next decade, The Hill reported. It faces stiff opposition from House Republicans.

Meanwhile, as energy expert Cooke predicts, the green business is still shaking out unsustainable ventures. The Danish wind company Vestas, which has several Colorado production sites, announced on Nov. 7 that it will shed 6,700 jobs through the end of next year.

Who’s to blame for the industry’s troubles? Government subsidies? Poorly run companies? Insufficient demand? Foreign competition?

Perlmutter blamed the Tea Party.

“It is clean and it is the future of energy production,” Perlmutter wrote on his website. “Until the Tea Party took over this has always been a simple, noncontroversial tax credit.”

Contact Tori Richards at tori@coloradowatchdog.org and Earl Glynn at earl.glynn@franklincenterhq.org.

AJ adds: Republicans and TEA Party people would not grouse if the DOE supported something that was viable without continued subsidy. Solar and wind are not the only boondoggle that the DOE had fostered upon us. At one point, the Department of Energy had a thorium cycle atomic power generator and it knew that this type of reactor was far more efficient and safer than the types of nuclear power plants eventually forced on us.

new frontier.

If you live outside Colorado, you probably haven’t heard of the National Renewable Energy Laboratory – NREL for short. It’s the place where solar panels, windmills and corn are deemed the energy source of the future and companies who support such endeavors are courted.

It’s also the place where highly paid staff decide how to spend hundreds of millions in taxpayer dollars.

And the public pays those decision-makers well: NREL’s top executive, Dr. Dan Arvizu, makes close to a million dollars per year. His two top lieutenants rake in more than half a million each and nine others make more than $350,000 a year.

But what is really going on there? Energy expert Amy Oliver Cooke drove out to the site, which looks something like Nevada’s Area 51 with its remote location and forbidding concrete buildings. NREL had started a construction project and Cooke wanted to see for herself. She didn’t get far: a man in an SUV seemingly appeared out of nowhere, stopped her car, and told her to leave.

“A beefy looking fellow told me, ‘It’s top secret,’ said Cooke, director of the Energy Policy Center at the Independence Institute think tank. “I said, ‘I’m a taxpayer and I want to see what you’re building’ and he said it was it was ‘top secret so we can bring Americans a better future.’”

With its bloated budget and overseen by a $533 million a year government-funded management company, Cooke isn’t buying it.

“NREL has given us two of the most significant boondoggles, one of them being ethanol and the other being (bankrupt) Abound Solar,” she said. “They were part of the team that pushed Abound Solar along. In fact, they wrote in March 2011 on their website how proud they were of their role in abound solar.

“Am I impressed with NREL? No, not really,” she said.

NREL’s taxpayer-funded management company has seen its budget more than double since 2006. That’s when one of its most ardent supporters, Rep. Ed Perlmutter D-Lakewood, was first elected to Congress. The lab sits in the middle of his district.

But Perlmutter’s ties go beyond merely promoting green legislation and lobbying his colleagues for NREL funds. He has received $12,670 in campaign contributions from executives of NREL and its management company, MRIGlobal, a company that describes itself as “an independent, not-for-profit organization that performs contract research for government and industry.” Perlmuter’s father has served as a trustee for MRI and MRIGlobal during the past decade. Between 2003 and 2005, Perlmutter was also a trustee. These positions were unpaid.

Perlmutter did not respond to phone calls seeking comment for this story.

FOLLOWING THE MONEY

Funded by the U.S. Department of Energy, NREL started in 1977 as the Solar Energy Research Institute, a Jimmy Carter-era response to the 1973 Mideast oil crisis. Its budget, then about $100 million, was slashed during the Reagan era.

By the time Perlmutter was elected, NREL’s budget was $209.6 million. It increased steadily before ballooning to $536.5, a beneficiary of President Obama’s stimulus plan and a $135 million contract spread out over five years to construct a new science center. Its current $352 million budget is down slightly from last year’s $388.6 million.

From its inception, NREL has been managed by MRIGlobal, back then called the Midwest Research Institute.

To handle lab management, MRIGlobal partnered with Ohio-based Battelle Memorial Institute, which describes itself as “the world’s largest nonprofit research and development organization.” The pair formed Alliance for Sustainable Energy, a separate non-profit in 2008, for the sole purpose of managing NREL and installed NREL’s top executives as its directors.

Despite record federal debt, municipal bankruptcies and a nagging global recession, those executives enjoy pay packages that are out of reach of most Americans who pay their salaries. MRIGlobal and Alliance tax documents obtained by Watchdog show most earned well into six-figures:

- Dan Arvizu, Alliance president and NREL director

2010: $928,069

2009: $691,570

2008: $652,159

- Bobi Garrett, NREL senior vice president of Outreach, Planning and Analysis

2010: $524,226.

2009: $398,022

- William Glover, NREL deputy lab director and CEO (retired)

2010: $557,571

2009: $407,361

2008: $315,465

- Catherine Porto, NREL senior vice president

2010: $406,339

2009: $223,553

The budget to manage Alliance is mind-boggling — and rising. For 2010, tax documents show, Alliance received $532.9 million from the Department of Energy, a whopping $189 million more than they were paid in 2008.In 2010, MRIGlobal’s tax return shows DOE funding of $104.8 million, while Battelle’s tax return reported $4.55 billion in government grants. Its activities included management of five national laboratories (including NREL) and operating as subcontractor at a sixth.

However, at least one expert who has studied NREL doesn’t see any problem with the fact that the agency is overseen by a management company.

“I have no problems with the contractors operating the lab. They would do a much more efficient job than the government,” said Nick Loris, an energy policy analyst with the Heritage Foundation. “It should lower the cost of these projects.”

But what Loris doesn’t like is the entire concept of placing the government in a role of making energy affordable. That should be a job for the private sector.

“It’s not the government’s role to make energy cheaper. There is no reason the taxpayer should subsidize this,” he said. “We’ve seen the failures when the government gets involved in these projects. If they are going to be successful in the marketplace, they wouldn’t need help from the government”

UNSUSTAINABLE LEVELS

In fact, the billions that have been siphoned into renewable energy have yet to produce a fraction of the promised return, Cooke claims.

Solar and wind still remain prohibitively expensive and not viable for general use as are corn and wood chips to fuel cars. Yet NREL labs continue to work to this end. Cooke predicts that numerous taxpayer-subsidized companies will go bankrupt in the coming years just as the overinflated housing market came crashing down.

And it’s not just the money, she said. It’s the environmental threat.

“I’ll tell you what’s pollution,” Cooke said. “It’s solar panels and wind turbines abandoned — things with toxic chemicals in them,” she said. “We don’t know what’s going to happen to these things. What do you do with a farm of abandoned wind turbines that are 500 feet tall?”

Despite its bloated stimulus funding, there are signs of financial trouble at NREL. The company offered to buy out 100 jobs when its budget dropped between 2011 and 2012.

Perlmutter spokeswoman Leslie Oliver expressed concern about the buyouts, calling NREL the nation’s green energy “crown jewel” and a driving economic force, the Denver Post reported.

“What about next year?” Oliver said. “Where does this stop?”

On his website, Perlmutter blamed Republicans for the cuts and claimed NREL generates 5,500 jobs. Its direct workforce is listed at 1,700.

By all accounts, Perlmutter’s relationship with NREL will continue. He spent two years trying to pass legislation to give solar companies a break with bankers before successfully adding the language to the American Clean Energy and Security Act of 2009.

He is co-chairman of the New Democrat Coalition Energy Task Force, part of the Financial Services Committee. Perlmutter has leveraged that role to keep alive a 20-year-old energy tax credit to producers of wind technology.

That credit would have expired at the end of the year. But the Financial Services Committee produced a bill to extend the credit for another year, which carries a cost of $12 billion over the next decade, The Hill reported. It faces stiff opposition from House Republicans.

Meanwhile, as energy expert Cooke predicts, the green business is still shaking out unsustainable ventures. The Danish wind company Vestas, which has several Colorado production sites, announced on Nov. 7 that it will shed 6,700 jobs through the end of next year.

Who’s to blame for the industry’s troubles? Government subsidies? Poorly run companies? Insufficient demand? Foreign competition?

Perlmutter blamed the Tea Party.

“It is clean and it is the future of energy production,” Perlmutter wrote on his website. “Until the Tea Party took over this has always been a simple, noncontroversial tax credit.”

Contact Tori Richards at tori@coloradowatchdog.org and Earl Glynn at earl.glynn@franklincenterhq.org.

AJ adds: Republicans and TEA Party people would not grouse if the DOE supported something that was viable without continued subsidy. Solar and wind are not the only boondoggle that the DOE had fostered upon us. At one point, the Department of Energy had a thorium cycle atomic power generator and it knew that this type of reactor was far more efficient and safer than the types of nuclear power plants eventually forced on us.

Friday, February 22, 2013

Collapse coming?

Larry Edelson predicted that the US will face an economic collapse, then an enormous amount of money printing and the take off in the gold prices.

Here is an exerpt from Seeking Alpha re the economic outlook:

"

So, what will the rest of 2013 bring? Hopefully the economy will remain stable for as long as possible, but right now things do not look particularly promising.

The following are 20 signs that the U.S. economy is heading for big trouble in the months ahead:

1. Freight shipment volumes have hit their lowest level in two years, and freight expenditures have gone negative for the first time since the last recession.

2. The average price of a gallon of gasoline has risen by more than 50 cents over the past two months. This is making things tougher on our economy, because nearly every form of economic activity involves moving people or goods around.

3. "Reader's Digest," once one of the most popular magazines in the world, has filed for bankruptcy.

4. Atlantic City's newest casino, Revel, has just filed for bankruptcy. It had been hoped that Revel would help lead a turnaround for Atlantic City.

5. A state-appointed review board has determined that there is "no satisfactory plan" to solve Detroit's financial emergency, and many believe that bankruptcy is imminent. If Detroit does declare bankruptcy, it will be the largest municipal bankruptcy in U.S. history.

6. David Gallagher, the CEO of Town Sports International, recently said that his company is struggling right now because consumers simply do not have as much disposable income anymore:

7. According to the Conference Board, consumer confidence in the U.S. has hit its lowest level in more than a year.

8. Sales of the iPhone have been slower than projected, and as a result Chinese manufacturing giant Foxconn has instituted a hiring freeze. The following is from a CNET report that was posted on Wednesday:

9. In 2012, global cell phone sales posted their first decline since the end of the last recession.

10. We appear to be in the midst of a "retail apocalypse." It is being projected that Sears (SHLD), J.C. Penney (JCP), Best Buy (BBY), and RadioShack (RSH) will also close hundreds of stores by the end of 2013.

11. An internal memo authored by a Wal-Mart (WMT) executive that was recently leaked to the press said that February sales were a "total disaster" and that the beginning of February was the "worst start to a month I have seen in my ~seven years with the company."

12. If Congress does not do anything and "sequestration" goes into effect on March 1, the Pentagon says that approximately 800,000 civilian employees will be facing mandatory furloughs.

13. Barack Obama is admitting that the "sequester" could have a crippling impact on the U.S. economy. The following is from a recent CNBC article:

14. If the "sequester" is allowed to go into effect, the CBO is projecting that it will cause U.S. GDP growth to go down by at least 0.6% and that it will "reduce job growth by 750,000 jobs."

15. According to a recent Gallup survey, 65% of all Americans believe that 2013 will be a year of "economic difficulty," and 50% of all Americans believe that the "best days" of America are now in the past.

16. U.S. GDP actually contracted at an annual rate of 0.1% during the fourth quarter of 2012. This was the first GDP contraction that the official numbers have shown in more than three years.

17. For the entire year of 2012, U.S. GDP growth was only about 1.5%. According to Art Cashin, every time GDP growth has fallen this low for an entire year, the U.S. economy has always ended up going into a recession.

18. The global economy overall is really starting to slow down:

19. Corporate insiders are dumping enormous amounts of stock right now. Do they know something that we don't?

20. Even some of the biggest names on Wall Street are warning that we are heading for an economic collapse. For example, Seth Klarman, one of the most respected investors on Wall Street, said in his year-end letter that the collapse of the U.S. financial system could happen at any time:

S

Here is an exerpt from Seeking Alpha re the economic outlook:

"

So, what will the rest of 2013 bring? Hopefully the economy will remain stable for as long as possible, but right now things do not look particularly promising.

The following are 20 signs that the U.S. economy is heading for big trouble in the months ahead:

1. Freight shipment volumes have hit their lowest level in two years, and freight expenditures have gone negative for the first time since the last recession.

2. The average price of a gallon of gasoline has risen by more than 50 cents over the past two months. This is making things tougher on our economy, because nearly every form of economic activity involves moving people or goods around.

3. "Reader's Digest," once one of the most popular magazines in the world, has filed for bankruptcy.

4. Atlantic City's newest casino, Revel, has just filed for bankruptcy. It had been hoped that Revel would help lead a turnaround for Atlantic City.

5. A state-appointed review board has determined that there is "no satisfactory plan" to solve Detroit's financial emergency, and many believe that bankruptcy is imminent. If Detroit does declare bankruptcy, it will be the largest municipal bankruptcy in U.S. history.

6. David Gallagher, the CEO of Town Sports International, recently said that his company is struggling right now because consumers simply do not have as much disposable income anymore:

As we moved into January, membership trends were tracking to expectations in the first half of the month, but fell off track and did not meet our expectations in the second half of the month. We believe the driver of this was the rapid decline in consumer sentiment that has been reported and is connected to the reduction in net pay consumers earn given the changes in tax rates that went into effect in January.

7. According to the Conference Board, consumer confidence in the U.S. has hit its lowest level in more than a year.

8. Sales of the iPhone have been slower than projected, and as a result Chinese manufacturing giant Foxconn has instituted a hiring freeze. The following is from a CNET report that was posted on Wednesday:

The Financial Times noted that it was the first time since a 2009 downturn that the company opted to halt hiring in all of its facilities across the country. The publication talked to multiple recruiters.

The actions taken by Foxconn fuel the concern over the perceived weakened demand for the iPhone 5 and slumping sentiment around Apple in general, with production activity a leading indicator of interest in the product.

9. In 2012, global cell phone sales posted their first decline since the end of the last recession.

10. We appear to be in the midst of a "retail apocalypse." It is being projected that Sears (SHLD), J.C. Penney (JCP), Best Buy (BBY), and RadioShack (RSH) will also close hundreds of stores by the end of 2013.

11. An internal memo authored by a Wal-Mart (WMT) executive that was recently leaked to the press said that February sales were a "total disaster" and that the beginning of February was the "worst start to a month I have seen in my ~seven years with the company."

12. If Congress does not do anything and "sequestration" goes into effect on March 1, the Pentagon says that approximately 800,000 civilian employees will be facing mandatory furloughs.

13. Barack Obama is admitting that the "sequester" could have a crippling impact on the U.S. economy. The following is from a recent CNBC article:

Obama cautioned that if the $85 billion in immediate cuts -- known as the sequester -- occur, the full range of government would feel the effects. Among those he listed: furloughed FBI agents, reductions in spending for communities to pay police and fire personnel and teachers, and decreased ability to respond to threats around the world.

He said the consequences would be felt across the economy.

'People will lose their jobs,' he said. 'The unemployment rate might tick up again.'

14. If the "sequester" is allowed to go into effect, the CBO is projecting that it will cause U.S. GDP growth to go down by at least 0.6% and that it will "reduce job growth by 750,000 jobs."

15. According to a recent Gallup survey, 65% of all Americans believe that 2013 will be a year of "economic difficulty," and 50% of all Americans believe that the "best days" of America are now in the past.

16. U.S. GDP actually contracted at an annual rate of 0.1% during the fourth quarter of 2012. This was the first GDP contraction that the official numbers have shown in more than three years.

17. For the entire year of 2012, U.S. GDP growth was only about 1.5%. According to Art Cashin, every time GDP growth has fallen this low for an entire year, the U.S. economy has always ended up going into a recession.

18. The global economy overall is really starting to slow down:

The world's richest countries saw their economies contract for the first time in almost four years during the final three months of 2012, the Organization for Economic Co-operation and Development said.

The Paris-based think-tank said gross domestic product across its 34 member states fell by 0.2% - breaking a period of rising activity stretching back to a 2.3% slump in output in the first quarter of 2009.

All the major economies of the OECD - the U.S., Japan, Germany, France, Italy, and the U.K. - have already reported falls in output at the end of 2012, with the think-tank noting that the steepest declines had been seen in the European Union, where GDP fell by 0.5%. Canada is the only member of the G7 currently on course to register an increase in national output.

19. Corporate insiders are dumping enormous amounts of stock right now. Do they know something that we don't?

20. Even some of the biggest names on Wall Street are warning that we are heading for an economic collapse. For example, Seth Klarman, one of the most respected investors on Wall Street, said in his year-end letter that the collapse of the U.S. financial system could happen at any time:

'Investing today may well be harder than it has been at any time in our three decades of existence,' writes Seth Klarman in his year-end letter. The Fed's 'relentless interventions and manipulations' have left few purchase targets for Baupost, he laments. '[The] underpinnings of our economy and financial system are so precarious that the unabating risks of collapse dwarf all other factors.'

S

Wednesday, February 20, 2013

What about inflation?

After Seeking Alpha published an article that US inflation is a myth (and that the prospect of hyperinflation is zero), I began to suspect that Alpha is up to its usual tricks of dishing out Obama regime propaganda. The regime is out to convince the public that:

a) the gold is still in the US vaults - no problem, move along and

b) that inflation is tame and we can continue with the insane money printing.

In order to continue with its scheme of price suppression, the FED needs to convince everyone that everything is OK, that the gold is there and its ownership (via athentication) is as expected. The quickest and clearest way to assure us would have been to return the 1,500 tons of German gold as requested by the German govt. The FED failed to do so and devised a scheme which will take several years if the return will actually happen. This raised suspicions that the gold is not there that it has been used in price suppression schemes and had been rented out and is gone (to China most likely). So, the FED decided to pull a propaganda stunt. The FED released an "audit" of America's gold reserves. The "audit" is causing more anxiety than it resolves. First, it is not an audit, but a report. What would an audit be like? It would have to verify every single gold bar, its authenticity, number and that it is really gold, as well as the history of ownership. That is an audit. What is in the report? It is a Treasury report of what is supposed to be there and only in the Federal Reserve Banks; in otherwise 5% of the gold and nothing said about the 95% which is not supposed to be at Federal Reserve Banks but at other locations. VERY UNCONVINCING.

How about inflation?

The BLS had changed the rules on reporting the numbers. According to current rules there is virtually no inflation:

Isn't that nice? We do not have to worry about COLAs for Soc Sec or govt retirees and can print Treasuries without regard to the effects of inflation.

Wait a minute though? Have you been to a grocery store lately, or gassed up your car? Oh yes, says the BLS, those things are not counted, because they are too volatile. The thing is though, that the rest of the inflation statistics are not hard data either, but numbers estimated according to new rules.

So, what would inflation look like acc to 1990 rules?

Here is the inflation data plotted according to 1980 rules:

The divergence is rather clear. Social Security payments have already been revised according to new rules that permit our own version of austerity. The government knows that if we had to pay interest on the $17T we owe at normal interest rates, it would cover over 80% of the govt revenue and no amount of tinkering with the tax code could cover it up.

a) the gold is still in the US vaults - no problem, move along and

b) that inflation is tame and we can continue with the insane money printing.

In order to continue with its scheme of price suppression, the FED needs to convince everyone that everything is OK, that the gold is there and its ownership (via athentication) is as expected. The quickest and clearest way to assure us would have been to return the 1,500 tons of German gold as requested by the German govt. The FED failed to do so and devised a scheme which will take several years if the return will actually happen. This raised suspicions that the gold is not there that it has been used in price suppression schemes and had been rented out and is gone (to China most likely). So, the FED decided to pull a propaganda stunt. The FED released an "audit" of America's gold reserves. The "audit" is causing more anxiety than it resolves. First, it is not an audit, but a report. What would an audit be like? It would have to verify every single gold bar, its authenticity, number and that it is really gold, as well as the history of ownership. That is an audit. What is in the report? It is a Treasury report of what is supposed to be there and only in the Federal Reserve Banks; in otherwise 5% of the gold and nothing said about the 95% which is not supposed to be at Federal Reserve Banks but at other locations. VERY UNCONVINCING.

How about inflation?

The BLS had changed the rules on reporting the numbers. According to current rules there is virtually no inflation:

Isn't that nice? We do not have to worry about COLAs for Soc Sec or govt retirees and can print Treasuries without regard to the effects of inflation.

Wait a minute though? Have you been to a grocery store lately, or gassed up your car? Oh yes, says the BLS, those things are not counted, because they are too volatile. The thing is though, that the rest of the inflation statistics are not hard data either, but numbers estimated according to new rules.

So, what would inflation look like acc to 1990 rules?

Here is the inflation data plotted according to 1980 rules:

The divergence is rather clear. Social Security payments have already been revised according to new rules that permit our own version of austerity. The government knows that if we had to pay interest on the $17T we owe at normal interest rates, it would cover over 80% of the govt revenue and no amount of tinkering with the tax code could cover it up.

Saturday, February 16, 2013

Updates

Europe's economy.

Sinking faster than previously reported. The Eurozone was down .5% in 2012 which has now increased to .6%. Greece, Spain, Portugal, Italy, Cyprus, the Netherlands and Finland are in recession. Germany's growth rate came in at -.6 in QIV and France's at -.3. France is deteriorating and England is in recession.

Gold's support at 1,650 gives way.

This is what the graph looked like on the thirteenth. The support held at 1650. And the following graph is three days later when support failed.

What can one make of this? Probably nothing. Economic numbers do not justify this breakdow though the gold market has stopped acting rationally a long time ago. In the past such takdowns were followed by rapid recovery.

Sinking faster than previously reported. The Eurozone was down .5% in 2012 which has now increased to .6%. Greece, Spain, Portugal, Italy, Cyprus, the Netherlands and Finland are in recession. Germany's growth rate came in at -.6 in QIV and France's at -.3. France is deteriorating and England is in recession.

Gold's support at 1,650 gives way.

This is what the graph looked like on the thirteenth. The support held at 1650. And the following graph is three days later when support failed.

What can one make of this? Probably nothing. Economic numbers do not justify this breakdow though the gold market has stopped acting rationally a long time ago. In the past such takdowns were followed by rapid recovery.

Friday, February 15, 2013

Financial Repression.

Financial Repression is a simple concept. By keeping interest rates below inflation, debts are supposed to go down. While, this is a somewhat murky concept, it isn't working. Debts in the US and in Europe are still rising though maybe slower. Add to this the problem of slow economic growth (which is now turning into a contraction) and governments continue with deficit spending.

There is an even more devastating development in the Western world and in the US in particular. The fancy word for it is cognitive dissonance - a total loss of the concept of cause and effect. The best example of this was the focus group run by Luntz during and after the 2012 State of the Union speech. Participants (even Romney voters) disagree with the trend of national affairs, disagree with the policies of Obama, yet they give Obama the benefit of doubt that he is trying. Obama and other Western leaders act as if someone else is running their countries. In fact, they campaign against the very policies (and the results of those policies) they are putting into place. The cognitive dissonance is not confined to the political class, but has invaded business as well. Some business leaders such as Buffet campaign for policies (higher taxes and more wasteful govt programs) that they know have a negative economic effect.

As long as the West is mired in the idiocies of Social Democracy (soft Socialism) the malaise will continue.

There is an even more devastating development in the Western world and in the US in particular. The fancy word for it is cognitive dissonance - a total loss of the concept of cause and effect. The best example of this was the focus group run by Luntz during and after the 2012 State of the Union speech. Participants (even Romney voters) disagree with the trend of national affairs, disagree with the policies of Obama, yet they give Obama the benefit of doubt that he is trying. Obama and other Western leaders act as if someone else is running their countries. In fact, they campaign against the very policies (and the results of those policies) they are putting into place. The cognitive dissonance is not confined to the political class, but has invaded business as well. Some business leaders such as Buffet campaign for policies (higher taxes and more wasteful govt programs) that they know have a negative economic effect.

As long as the West is mired in the idiocies of Social Democracy (soft Socialism) the malaise will continue.

Monday, February 11, 2013

European snap shot.

European economic output.

While, officially only 7 of 17 countries are experiencing recession, European economic output has dropped 0.4% during QIV of 2012. Germany has dropped 0.4% and France has dropped 0.2%. Draghi claims that QIV was the bottom and expects recovery this quarter, such as Germany putting in a growth of 0.1%. However, France is expected to drop further. Much of the expected recovery is based on expectations that the US will recover and exports to the US will increase. US recovery is spotty though and the two recent winter storms will slow US output.

Russia: working to rebuild gold reserve.

Economists believe that a strong economy needs a strong and stable currency. Vladimir Putin has put Russia on track toward that goal. First, Russia has become a petroleum product exporting country. Petroleum is a hard currency shunned only by idiots (such as American Liberals and environmentalist whackoes, but I repeat myself). Putin claims that America is abusing the privilege of having the world's reserve currency (he got Obama's number), so Russia under Putin has been buying gold. How much gold? Russia's gold reserves now amount to 10% of their total reserves: 958 tons, of which 570 tons were acquired during Putin's tenure. Add the fact that Russia has an income tax of 13% flat and you can see the making of Russian recovery from 70 years of Socialism.

While Russia and China are getting set to replace the US Dollar, the idiots of Europe have sold their gold: 977 tons by Schweiz, 589 tons by France and over 200 tons each by Spain, the Netherlands and Portugal. England sold a bunch when gold was selling for $450/0z. Italy hung on to theirs, but half of Germany's gold was loaned for price suppression and is gone.

Denmark.

Basel III specifies that countries can use government bonds and gold as collateral as Tier One assets. This creates problems for the Danish, because they use their mortgage bonds as well. The bursting of the housing bubble has put Denmark into recession and any further shocks may drive them out of the EU.

The lucrative field of metal thievery.

Because of the high price of metals, stealing and selling metals has become a problem, especially in Greece.

While, officially only 7 of 17 countries are experiencing recession, European economic output has dropped 0.4% during QIV of 2012. Germany has dropped 0.4% and France has dropped 0.2%. Draghi claims that QIV was the bottom and expects recovery this quarter, such as Germany putting in a growth of 0.1%. However, France is expected to drop further. Much of the expected recovery is based on expectations that the US will recover and exports to the US will increase. US recovery is spotty though and the two recent winter storms will slow US output.

Russia: working to rebuild gold reserve.

Economists believe that a strong economy needs a strong and stable currency. Vladimir Putin has put Russia on track toward that goal. First, Russia has become a petroleum product exporting country. Petroleum is a hard currency shunned only by idiots (such as American Liberals and environmentalist whackoes, but I repeat myself). Putin claims that America is abusing the privilege of having the world's reserve currency (he got Obama's number), so Russia under Putin has been buying gold. How much gold? Russia's gold reserves now amount to 10% of their total reserves: 958 tons, of which 570 tons were acquired during Putin's tenure. Add the fact that Russia has an income tax of 13% flat and you can see the making of Russian recovery from 70 years of Socialism.

While Russia and China are getting set to replace the US Dollar, the idiots of Europe have sold their gold: 977 tons by Schweiz, 589 tons by France and over 200 tons each by Spain, the Netherlands and Portugal. England sold a bunch when gold was selling for $450/0z. Italy hung on to theirs, but half of Germany's gold was loaned for price suppression and is gone.

Denmark.

Basel III specifies that countries can use government bonds and gold as collateral as Tier One assets. This creates problems for the Danish, because they use their mortgage bonds as well. The bursting of the housing bubble has put Denmark into recession and any further shocks may drive them out of the EU.

The lucrative field of metal thievery.

Because of the high price of metals, stealing and selling metals has become a problem, especially in Greece.

Sunday, February 10, 2013

The interestrate/bond price teeter totter.

If you are curious about the inter-relationship of equity, interest rate and bond prices, there is a fantastically lucid explanation:

http://kingworldnews.com/kingworldnews/KWN_DailyWeb/Entries/2013/2/7_Calls_For_Printing_$30_-_$100_Trillion_Now,_It_Is_Out_Of_Control.html

While, the explanation is lucid, the definitions of equity, debt and such is difficult to understand. It took me several readings to digest it. It is the same with Accounting. Whet you feel intuitively should be credit, is defined as a debit and so on.

However, the definition by FitzWilson pays off for you when he discusses the relationship of interest rate and bond prices. The two vary reciprocally: that is, when interest rate goes up bond prices go down and vice verse. The explanation lies in the fact that a bond varies in price in terms of the income it generates.

Let's say you buy a bond that pays 5% interest. That amounts to $50/year. If interest rates double, new bonds will pay $100/yr and people who have the 5% bonds will try to sell the old bonds to buy the new ones. So, the 5% bonds will lose value untill they lost 1/2 of their value, so for $1000 you can now buy either one 10% bond or two 5% bonds.

The current situation represents the top for bond values, because interest rates are very low. When interest rates will start to rise, bond values will drop, especially Treasuries. The current yield on Treasuries is negative because the yield is 2% on the 30Y T bill, while inflation is 2% officially and about 8% acc to ShadowStat. So, why do people by Treasuries if they are losing money by buying them? Because of fear.

We see the 20s recapitulated when the FED quadrupled its balance sheet. The early Depression following WWI was done away with by reducing govt spending by over 60%. A Stock Market crash followed and then the Depression. Hyperinflation was avoided by the economic collapse. The Obama regime is repeating the same mistakes.

http://kingworldnews.com/kingworldnews/KWN_DailyWeb/Entries/2013/2/7_Calls_For_Printing_$30_-_$100_Trillion_Now,_It_Is_Out_Of_Control.html

While, the explanation is lucid, the definitions of equity, debt and such is difficult to understand. It took me several readings to digest it. It is the same with Accounting. Whet you feel intuitively should be credit, is defined as a debit and so on.

However, the definition by FitzWilson pays off for you when he discusses the relationship of interest rate and bond prices. The two vary reciprocally: that is, when interest rate goes up bond prices go down and vice verse. The explanation lies in the fact that a bond varies in price in terms of the income it generates.

Let's say you buy a bond that pays 5% interest. That amounts to $50/year. If interest rates double, new bonds will pay $100/yr and people who have the 5% bonds will try to sell the old bonds to buy the new ones. So, the 5% bonds will lose value untill they lost 1/2 of their value, so for $1000 you can now buy either one 10% bond or two 5% bonds.

The current situation represents the top for bond values, because interest rates are very low. When interest rates will start to rise, bond values will drop, especially Treasuries. The current yield on Treasuries is negative because the yield is 2% on the 30Y T bill, while inflation is 2% officially and about 8% acc to ShadowStat. So, why do people by Treasuries if they are losing money by buying them? Because of fear.

We see the 20s recapitulated when the FED quadrupled its balance sheet. The early Depression following WWI was done away with by reducing govt spending by over 60%. A Stock Market crash followed and then the Depression. Hyperinflation was avoided by the economic collapse. The Obama regime is repeating the same mistakes.

Friday, February 8, 2013

The call to print $30T. Or, maybe $100T.

The use of financial derivatives is out of control. What are these derivatives? Basically, they are paper bets on a lot of things. The problem is how to value them when it comes to requirements of the financial institutions. If your bank places a $10B bet that interest rates will go up, what is the consequence of this? How much margin is your bank to put down? What is the value of the bet? Then your bank buys an insurance against losing (i.e. that interest rates will go up or down - depends whether the bet is a call or a put). now what happens? As these issues got murkier, there was a proposal to codify margin requirements on these bets. Financial entities responded that this may require up to $30T in deposits:

http://dealbook.nytimes.com/2012/10/29/behind-estimated-30-trillion-drain-a-lot-of-hypothetical-assumptions/

http://dealbook.nytimes.com/2012/10/29/behind-estimated-30-trillion-drain-a-lot-of-hypothetical-assumptions/

Thursday, February 7, 2013

Fiscal Devaluation of Gita Gopinath.

Gita Gopinath is an India-born economist at Harvard. She has revived a proposal of Keynes to escape economic discipline imposed by a common currency (such as the Euro) or the gold standard (as in the times of Keynes). Here is how it works:

A country can raise its VAT and lower its payroll taxes. The VAT applies to imports but not to exports. The higher VAT increases the tax on imports (so it is protectionist that way), while the lowered payroll taxes promote exports. This, in fact, simulates the effects of a weaker currency. The increased VAT also brings in more tax revenue and so does the increase in exports. That's how this works theoretically.

This type of change in tax policy was done in Germany in 2007 and the VAT was changed from 16% to 19%. It is being considered in France. A rigorous analysis of the effects of fiscal devaluation will take some research, but I will provide a theoretical evaluation now.

Fiscal devaluation has one desirable effect (reduced payroll taxes) and two potentially harmful consequences arising from increasing the VAT. Increasing the VAT is increasing taxes paid not only by foreign companies, but also by the taxpayers as well. Governments may view increased revenues as desirable, but tax payers do not. Thus, increased taxes may reduce economic growth. And protectionist measures will bring on retaliation. That will be a negative factor on trade.

In the end, there is no free lunch and there is no substitute for hard work, a good work ethic and keeping governments as small as possible. Capital, in the hands of private individuals will produce more revenue than capital in the hands of government functionaries. Why? Because private individuals tend to favor profit and efficiency (and if they do not they fail), whereas government functionaries have other (less profitable) ideas and their failure will be financed out of taxes.

That said, fiscal devaluation may help a country such as Greece.

A country can raise its VAT and lower its payroll taxes. The VAT applies to imports but not to exports. The higher VAT increases the tax on imports (so it is protectionist that way), while the lowered payroll taxes promote exports. This, in fact, simulates the effects of a weaker currency. The increased VAT also brings in more tax revenue and so does the increase in exports. That's how this works theoretically.

This type of change in tax policy was done in Germany in 2007 and the VAT was changed from 16% to 19%. It is being considered in France. A rigorous analysis of the effects of fiscal devaluation will take some research, but I will provide a theoretical evaluation now.

Fiscal devaluation has one desirable effect (reduced payroll taxes) and two potentially harmful consequences arising from increasing the VAT. Increasing the VAT is increasing taxes paid not only by foreign companies, but also by the taxpayers as well. Governments may view increased revenues as desirable, but tax payers do not. Thus, increased taxes may reduce economic growth. And protectionist measures will bring on retaliation. That will be a negative factor on trade.

In the end, there is no free lunch and there is no substitute for hard work, a good work ethic and keeping governments as small as possible. Capital, in the hands of private individuals will produce more revenue than capital in the hands of government functionaries. Why? Because private individuals tend to favor profit and efficiency (and if they do not they fail), whereas government functionaries have other (less profitable) ideas and their failure will be financed out of taxes.

That said, fiscal devaluation may help a country such as Greece.

Tuesday, February 5, 2013

Europe: Spain and fraud.

If you read the headlines, you would think that Spain is a land of fraud and corruption.

Chinese gang fraud;

Nigerian gang carries on lottery fraud ( I myself get letters of my winnings);

Ten Britons arrested for running a 'boiler room scam':

And five Brits arrested over missing VAT funds.

The alleged bank fraud at Bankia (the bank made up from bad banks);

Bankia has promoted fraud, embezzlement, price manipulation and falsifying accounts. No charges so far, but Finance Minister Guidos has been asked to testify.

The biggest stink covers the ruling party, the PP. Various officials are said to have collected bribes of 5-15,000 Euros/month.

There has been an uptick in bond yields in Europe. Ten year bond yields of Spain hit 6.44%, of Italy 4.45% and Portugal 6.42%. These yields have come down today to 5.37%, 4.44% and 6.42%. Economic performance is said to have stabilized.

Chinese gang fraud;

Nigerian gang carries on lottery fraud ( I myself get letters of my winnings);

Ten Britons arrested for running a 'boiler room scam':

And five Brits arrested over missing VAT funds.

The alleged bank fraud at Bankia (the bank made up from bad banks);

Bankia has promoted fraud, embezzlement, price manipulation and falsifying accounts. No charges so far, but Finance Minister Guidos has been asked to testify.

The biggest stink covers the ruling party, the PP. Various officials are said to have collected bribes of 5-15,000 Euros/month.

There has been an uptick in bond yields in Europe. Ten year bond yields of Spain hit 6.44%, of Italy 4.45% and Portugal 6.42%. These yields have come down today to 5.37%, 4.44% and 6.42%. Economic performance is said to have stabilized.

Monday, February 4, 2013

One of the predictions of Larry Edelson is that Bernanke will keep printing to stimulate the economy, but will fail. We know that the FED is printing $85B/Month. What is the sign of 'failing to improve the economy?' There are several measures we can consult: 1. Gross National Product - anemic, actually fell during QIV of 2012; 2. Employment - woeful; and 3. Money velocity: i.e M1 and M2.

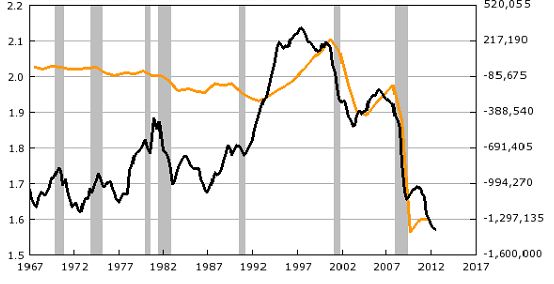

Here is the velocity of M1 (black) and the deficit(yellow):

And here is the velocuty of M2 (black) and the deficit (yellow):

What do the graphs tell us? M1 is a measure of the movement of money on a narrower base and M2 is velocity on a broader base. NOTE! These garphs represent VELOCITY, NOT just total. In fact, M1 and M2 are increasing very rapidly, but the money is tied up.

What the graphs tell us is that the problem is NOT that there is not enough money, but that its CIRCULATION is inhibited. That is to say we do not have a financial problem but a structural problem. That is why Larry says that money printing will not improve the economy.

Here is the velocity of M1 (black) and the deficit(yellow):

And here is the velocuty of M2 (black) and the deficit (yellow):

What do the graphs tell us? M1 is a measure of the movement of money on a narrower base and M2 is velocity on a broader base. NOTE! These garphs represent VELOCITY, NOT just total. In fact, M1 and M2 are increasing very rapidly, but the money is tied up.

What the graphs tell us is that the problem is NOT that there is not enough money, but that its CIRCULATION is inhibited. That is to say we do not have a financial problem but a structural problem. That is why Larry says that money printing will not improve the economy.

Saturday, February 2, 2013

Adjusted numbers.

America's jobs are melting away. Since Obama became President, the Country lost 8.5M jobs NET! That means that we are losing jobs faster than they are created. What is worse is the way the news is being reported.

Take the latest propaganda about the "recovery." The Media reports a big drop in newly unemployed. If you examine the number, you find that what is reported is an "adjusted" number. The raw number is as bad as in previous months. The reporting gets worse. New jobs created has increased reports the breathless CNN infobabe. And November and December new jobs have been revised upward - significantly I might add. Then comes the jolt: the % unemployed actually went up, while the GDP decreased in QIV of last year.

So, jobs lost went down, jobs gained went up and so did the percent unemployed. All during a period of economic contraction. How can this be? Well, the Obama regime uses adjusted and raw numbers and reports what looks better. And the Media reports "recovery." The low information voters are clueless as usual. The Media is happy to report that Obama's approval rating is up. On the cusp of a possible recession.

Take the latest propaganda about the "recovery." The Media reports a big drop in newly unemployed. If you examine the number, you find that what is reported is an "adjusted" number. The raw number is as bad as in previous months. The reporting gets worse. New jobs created has increased reports the breathless CNN infobabe. And November and December new jobs have been revised upward - significantly I might add. Then comes the jolt: the % unemployed actually went up, while the GDP decreased in QIV of last year.

So, jobs lost went down, jobs gained went up and so did the percent unemployed. All during a period of economic contraction. How can this be? Well, the Obama regime uses adjusted and raw numbers and reports what looks better. And the Media reports "recovery." The low information voters are clueless as usual. The Media is happy to report that Obama's approval rating is up. On the cusp of a possible recession.

Friday, February 1, 2013

Have the 30Y Treasuries cracked?

Larry Edelson had predicted that there would be a 'crack' in 30Y Treasuries followed by a deluge of US Dollars flowing into stocks and gold. Well, the 30Y Treasuries cracked as it fell below the support level of 144 all the way to 142. We can at this point expect a reaction rally to 143, but the next support level is 135.

There is more significance to this move than readily apparent. It reflects the Chinese 'de- Americanization.' Between Obama's spending spree and Bernanke's willingness to underwrite it by printing money, Chinese holdings of reserves have suffered an estimated 30% loss of value. The tsunami of counterfeiting of the US Dollar on such a scale is igniting countermeasures. One countermeasure is the currency wars. The other measure is 'de-Americanization,' selling off of Treasuries. Yet another defencive measure is the conducting of business in other currencies than US Dollars. The Chinese are buying any and all gold that they can so the Yuan will be backed by gold. The FED is financing the periodic takedowns of gold prices in the London and Zurich markets (NY does not trade bouillon, only paper gold). The FED action promotes Chinese efforts to buy gold cheap. KWN reports that Goldman-Sux has a short position in silver that equals nearly the available silver supply. As the paper position in gold is 100X the available supply, there is a great deal of question as to what will happen when owners of the contracts attempt to get delivery. These will be interesting times.

There is more significance to this move than readily apparent. It reflects the Chinese 'de- Americanization.' Between Obama's spending spree and Bernanke's willingness to underwrite it by printing money, Chinese holdings of reserves have suffered an estimated 30% loss of value. The tsunami of counterfeiting of the US Dollar on such a scale is igniting countermeasures. One countermeasure is the currency wars. The other measure is 'de-Americanization,' selling off of Treasuries. Yet another defencive measure is the conducting of business in other currencies than US Dollars. The Chinese are buying any and all gold that they can so the Yuan will be backed by gold. The FED is financing the periodic takedowns of gold prices in the London and Zurich markets (NY does not trade bouillon, only paper gold). The FED action promotes Chinese efforts to buy gold cheap. KWN reports that Goldman-Sux has a short position in silver that equals nearly the available silver supply. As the paper position in gold is 100X the available supply, there is a great deal of question as to what will happen when owners of the contracts attempt to get delivery. These will be interesting times.

Subscribe to:

Comments (Atom)