One of the predictions of Larry Edelson is that Bernanke will keep printing to stimulate the economy, but will fail. We know that the FED is printing $85B/Month. What is the sign of 'failing to improve the economy?' There are several measures we can consult: 1. Gross National Product - anemic, actually fell during QIV of 2012; 2. Employment - woeful; and 3. Money velocity: i.e M1 and M2.

Here is the velocity of M1 (black) and the deficit(yellow):

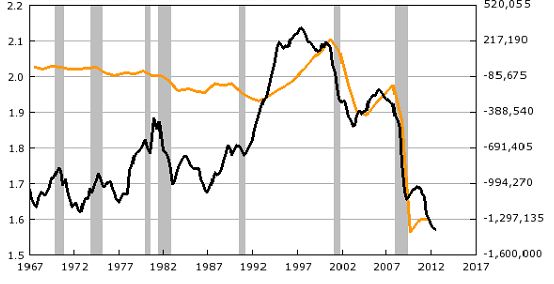

And here is the velocuty of M2 (black) and the deficit (yellow):

What do the graphs tell us? M1 is a measure of the movement of money on a narrower base and M2 is velocity on a broader base. NOTE! These garphs represent VELOCITY, NOT just total. In fact, M1 and M2 are increasing very rapidly, but the money is tied up.

What the graphs tell us is that the problem is NOT that there is not enough money, but that its CIRCULATION is inhibited. That is to say we do not have a financial problem but a structural problem. That is why Larry says that money printing will not improve the economy.

Subscribe to:

Post Comments (Atom)

No comments:

Post a Comment